Instructions For 2012 Nc-478 Series

ADVERTISEMENT

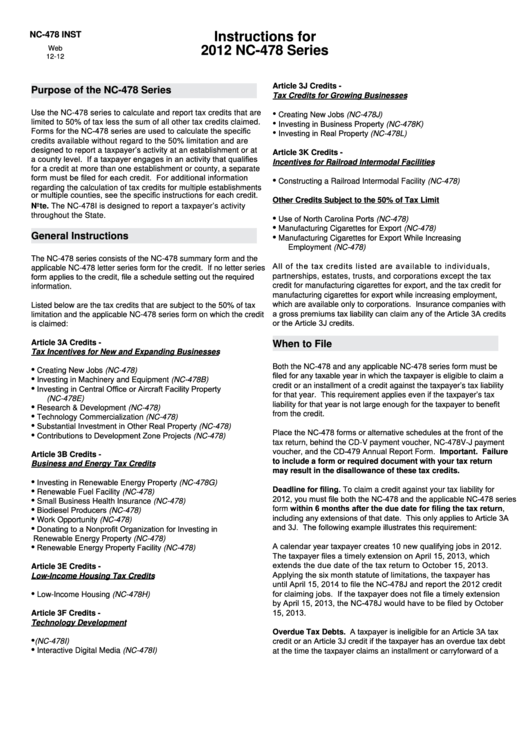

NC-478 INST

Instructions for

2012 NC-478 Series

Web

12-12

Article 3J Credits -

Purpose of the NC-478 Series

Tax Credits for Growing Businesses

Use the NC-478 series to calculate and report tax credits that are

•

Creating New Jobs (NC-478J)

limited to 50% of tax less the sum of all other tax credits claimed.

Investing in Business Property (NC-478K)

•

Forms for the NC-478 series are used to calculate the specific

Investing in Real Property (NC-478L)

•

credits available without regard to the 50% limitation and are

designed to report a taxpayer’s activity at an establishment or at

Article 3K Credits -

a county level. If a taxpayer engages in an activity that qualifies

Incentives for Railroad Intermodal Facilities

for a credit at more than one establishment or county, a separate

form must be filed for each credit. For additional information

•

Constructing a Railroad Intermodal Facility (NC-478)

regarding the calculation of tax credits for multiple establishments

or multiple counties, see the specific instructions for each credit.

Other Credits Subject to the 50% of Tax Limit

Note. The NC-478I is designed to report a taxpayer’s activity

throughout the State.

Use of North Carolina Ports (NC-478)

•

•

Manufacturing Cigarettes for Export (NC-478)

General Instructions

•

Manufacturing Cigarettes for Export While Increasing

Employment (NC-478)

The NC-478 series consists of the NC-478 summary form and the

All of the tax credits listed are available to individuals,

applicable NC-478 letter series form for the credit. If no letter series

form applies to the credit, file a schedule setting out the required

partnerships, estates, trusts, and corporations except the tax

credit for manufacturing cigarettes for export, and the tax credit for

information.

manufacturing cigarettes for export while increasing employment,

which are available only to corporations. Insurance companies with

Listed below are the tax credits that are subject to the 50% of tax

a gross premiums tax liability can claim any of the Article 3A credits

limitation and the applicable NC-478 series form on which the credit

or the Article 3J credits.

is claimed:

Article 3A Credits -

When to File

Tax Incentives for New and Expanding Businesses

Both the NC-478 and any applicable NC-478 series form must be

•

Creating New Jobs (NC-478)

filed for any taxable year in which the taxpayer is eligible to claim a

•

Investing in Machinery and Equipment (NC-478B)

credit or an installment of a credit against the taxpayer’s tax liability

Investing in Central Office or Aircraft Facility Property

•

for that year. This requirement applies even if the taxpayer’s tax

(NC-478E)

liability for that year is not large enough for the taxpayer to benefit

•

Research & Development (NC-478)

from the credit.

•

Technology Commercialization (NC-478)

Substantial Investment in Other Real Property (NC-478)

•

Place the NC-478 forms or alternative schedules at the front of the

Contributions to Development Zone Projects (NC-478)

•

tax return, behind the CD-V payment voucher, NC-478V-J payment

voucher, and the CD-479 Annual Report Form. Important. Failure

Article 3B Credits -

to include a form or required document with your tax return

Business and Energy Tax Credits

may result in the disallowance of these tax credits.

Investing in Renewable Energy Property (NC-478G)

•

Deadline for filing. To claim a credit against your tax liability for

•

Renewable Fuel Facility (NC-478)

2012, you must file both the NC-478 and the applicable NC-478 series

•

Small Business Health Insurance (NC-478)

form within 6 months after the due date for filing the tax return,

Biodiesel Producers (NC-478)

•

including any extensions of that date. This only applies to Article 3A

•

Work Opportunity (NC-478)

and 3J. The following example illustrates this requirement:

Donating to a Nonprofit Organization for Investing in

•

Renewable Energy Property (NC-478)

A calendar year taxpayer creates 10 new qualifying jobs in 2012.

Renewable Energy Property Facility (NC-478)

•

The taxpayer files a timely extension on April 15, 2013, which

extends the due date of the tax return to October 15, 2013.

Article 3E Credits -

Applying the six month statute of limitations, the taxpayer has

Low-Income Housing Tax Credits

until April 15, 2014 to file the NC-478J and report the 2012 credit

for claiming jobs. If the taxpayer does not file a timely extension

•

Low-Income Housing (NC-478H)

by April 15, 2013, the NC-478J would have to be filed by October

15, 2013.

Article 3F Credits -

Technology Development

Overdue Tax Debts. A taxpayer is ineligible for an Article 3A tax

credit or an Article 3J credit if the taxpayer has an overdue tax debt

•

N.C. Research and Development (NC-478I)

•

Interactive Digital Media (NC-478I)

at the time the taxpayer claims an installment or carryforward of a

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2