INSTRUCTIONS FOR ALLOCATION AND COMPUTATION SCHEDULE

(A) List each beneficiary by name and address, age, relationship and the amount assigned in Column (1), (2), (3) and (4).

(B) Select the tax table, which has the exemption built into it, according to transferee’s relationship to the decedent.

Tables 1- 1G: Lineal issue: son, daughter, grandson, granddaughter, adopted child, mutually acknowledged child or stepchild (where

decedent died after July 1, 1994).

Table 2: Lineal ancestor: father, mother, grandfather, grandmother.

Table 3: Brother, sister, nephew, niece, and their issue, son-in-law, daughter-in-law.

Table 4: Uncle, aunt, first cousins and their issue.

Table 5: Stranger in blood, a body politic or corporate.

Table 6: Transferee with qualifying property under SDCL 10-40-21(6).

(C) Compute the inheritance tax imposed on each beneficiary using the Tax Table and insert in Column (5).

(Instructions continued on next page)

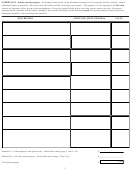

Table 1: SDCL 10-40-21(1)

Table 1D: SDCL 10-40-21(1D)

(For persons dying on or before June 30, 2000)

(For persons dying July 1, 2003 to June 30, 2004, inclusive)

If the amount assigned is:

If the amount assigned is:

over

but not over

the tax due is

of the amount over

over

but not over

the tax due is

of the amount over

30,000

50,000

3 3/4%

30,000

70,000

100,000

6%

70,000

50,000

100,000

$750+6%

50,000

100,000

----------

$1800+7 1/2%

100,000

100,000

---------

$3750+7 1/2%

100,000

Table 1E: SDCL 10-40-21(1)

Table 1A: SDCL 10-40-21(1)

(For persons dying July 1, 2004 to June 30, 2005, inclusive)

(For persons dying July 1, 2000 to June 30, 2001, inclusive)

If the amount assigned is

If the amount assigned is:

over

but not over

the tax due is

of the amount over

over

but not over

the tax due is

of the amount over

80,000

100,000

6%

80,000

40,000

50,000

3 3/4%

40,000

100,000

---------

$1200+7 1/2%

100,000

50,000

100,000

$375+6%

50,000

100,000

---------

$3375+7 1/2%

100,000

Table 1B: SDCL 10-40-21(1)

Table 1F: SDCL 10-40-21(1)

(For persons dying July 1, 2001 to June 30, 2002, inclusive)

(For persons dying July 1, 2005 to June 30, 2006, inclusive)

If the amount assigned is:

If the amount assigned is

over

but not over

the tax due is

of the amount over

over

but not over

the tax due is

of the amount over

50,000

100,000

6%

50,000

90,000

100,000

6%

90,000

100,000

---------

$3,000+7 1/2%

100,000

100,000

---------

$600+7 1/2%

100,000

Table 1C: SDCL 10-40-21(1)

Table 1G: SDCL 10-40-21(1)

(For persons dying July 1, 2002 to June 30, 2003, inclusive)

(For persons dying on or after July 1, 2006)

If the amount assigned is:

If the amount assigned is:

over

but not over

the tax due is

of the amount over

over

the tax due is

of the amount over

60,000

100,000

6%

60,000

100,000

7 1/2%

100,000

100,000

----------

$2400+7 1/2

100,000

(Tax tables continued on next page)

8

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9