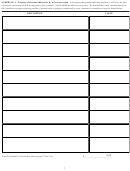

Table 5: SDCL 10-40-21 (5)

Table 2: SDCL 10-40-21 (2)

If the amount assigned is:

If the amount assigned is:

over

but not over

the tax due is

of the amount over

over

but not over

the tax due is

of the amount over

100

15,000

6%

100

3,000

15,000

3%

3,000

15,000

50,000

$894+15%

15,000

15,000

50,000

$360+7 1/2%

15,000

50,000

100,000

$6144+24%

50,000

50,000

100,000

$2985+12%

50,000

100,000

----------

$18,144+30%

100,000

100,000

---------

$8985+15%

100,000

Table 3: SDCL 10-40-21(3)

Table 6: SDCL 10-40-21(6)

If the amount assigned is:

If the amount assigned is:

over

but not over

the tax due is

of the amount over

over

but not over

the tax due is

of the amount over

500

15,000

4%

500

0

15,000

3%

0

15,000

50,000

$580+10%

15,000

15,000

50,000

$450+7 1/2%

15,000

50,000

100,000

$4080+16%

50,000

50,000

100,000

$3075+12%

50,000

100,000

---------

$12,080+20%

100,000

100,000

----------

$9075+15%

100,000

Table 4: SDCL 10-40-21(4)

If the amount assigned is:

over

but not over

the tax due is

of the amount over

200

15,000

5%

200

15,000

50,000

$740+12 1/2%

15,000

50,000

100,000

$5115+20%

50,000

100,000

---------

$15,115+25%

100,000

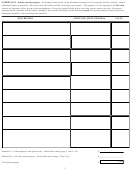

(Instructions for allocation and computation schedule continued from page 8)

(D)

List the total amount assigned on Line 12 of the Allocation and Computation Schedule. (This should equal line 11(h) on page 1.)

(E)

Of the assets listed on schedules A through C-1, and taking into account farm and business debts listed on schedule D, please list the net

value of assets of continuing farms and businesses described on line 12a.

If a business has to be liquidated to pay death taxes, line 12b is an opportunity to explain to state government the impact of such taxes.

(F)

List the total inheritance tax imposed on Line 13.

(G)

Determine the amount of federal credit for state death taxes and compute the South Dakota estate tax on Line 14.

(H)

Enter total estimated tax due on Line 15.

(I)

Compute the interest due if the tax was not paid within the first year after death and insert on Line 16 (a), (b) or (c) . If decedent died

before July 1, 1991, interest is computed at the rate of 1 1/2% per month or fraction thereof from one year after the date of death. If

decedent died on or after July 1, 1991, the interest is computed at the Category B rate established by SDCL 54-3-16 from one year after

date of death. The interest that is chargeable for deaths occurring after July 1, 1994, is 10% pursuant to SDCL 54-3-16. If there is no

interest due, leave Lines16 (a), (b) and (c) blank.

(J)

Add total inheritance tax, estate tax and interest due and insert on Line 17.

(K)

Enter the amount of inheritance or estate tax previously paid or any estimated payment made on Line 18.

(L)

The balance due figure is shown on Line 19 and the refund amount claimed figure is shown on Line 20.

PAYMENTS SHOULD BE MADE PAYABLE TO: South Dakota State Treasurer and sent to the Remittance Processing Center,

P. O. Box 5055, Sioux Falls, South Dakota 57117-5055.

9

PRINT FOR MAILING

CLEAR FORM

1.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9