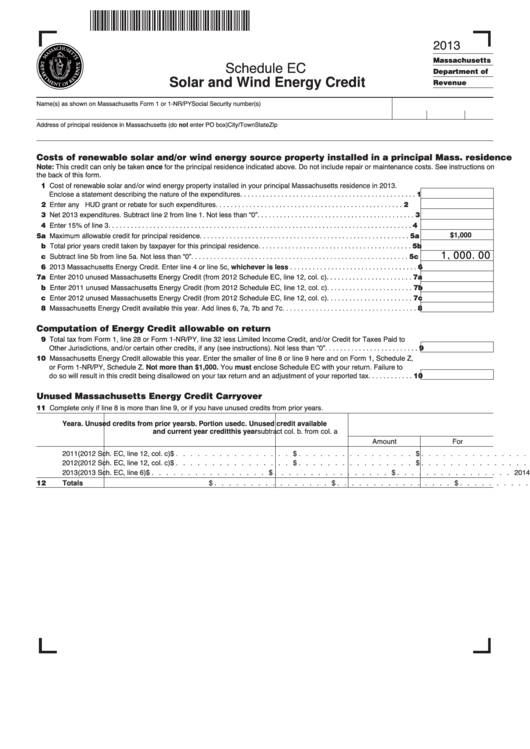

2013

Schedule EC

Massachusetts

Department of

Solar and Wind Energy Credit

Revenue

Name(s) as shown on Massachusetts Form 1 or 1-NR/PY

Social Security number(s)

Address of principal residence in Massachusetts (do not enter PO box)

City/Town

State

Zip

Note: This credit can only be taken once for the principal residence indicated above. Do not include repair or maintenance costs. See instructions on

Costs of renewable solar and/or wind energy source property installed in a principal Mass. residence

the back of this form.

91 Cost of renewable solar and/or wind energy property installed in your principal Massachusetts residence in 2013.

Enclose a statement describing the nature of the expenditures. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

92 Enter any U.S. HUD grant or rebate for such expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

93 Net 2013 expenditures. Subtract line 2 from line 1. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

94 Enter 15% of line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5a Maximum allowable credit for principal residence . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5a

$1,000

9b Total prior years credit taken by taxpayer for this principal residence . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

7c Subtract line 5b from line 5a. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5c

1,000.00

96 2013 Massachusetts Energy Credit. Enter line 4 or line 5c, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7a Enter 2010 unused Massachusetts Energy Credit (from 2012 Schedule EC, line 12, col. c) . . . . . . . . . . . . . . . . . . . . . . . 7a

9b Enter 2011 unused Massachusetts Energy Credit (from 2012 Schedule EC, line 12, col. c) . . . . . . . . . . . . . . . . . . . . . . . 7b

9c Enter 2012 unused Massachusetts Energy Credit (from 2012 Schedule EC, line 12, col. c) . . . . . . . . . . . . . . . . . . . . . . . 7c

08 Massachusetts Energy Credit available this year. Add lines 6, 7a, 7b and 7c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Computation of Energy Credit allowable on return

09 Total tax from Form 1, line 28 or Form 1-NR/PY, line 32 less Limited Income Credit, and/or Credit for Taxes Paid to

Other Jurisdictions, and/or certain other credits, if any (see instructions). Not less than “0”. . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Massachusetts Energy Credit allowable this year. Enter the smaller of line 8 or line 9 here and on Form 1, Schedule Z,

or Form 1-NR/PY, Schedule Z. Not more than $1,000. You must enclose Schedule EC with your return. Failure to

do so will result in this credit being disallowed on your tax return and an adjustment of your reported tax . . . . . . . . . . . . 10

Unused Massachusetts Energy Credit Carryover

11 Complete only if line 8 is more than line 9, or if you have unused credits from prior years.

subtract col. b. from col. a

Year

a. Unused credits from prior years

b. Portion used

c. Unused credit available

Amount

For

and current year credit

this year

2011

(2012 Sch. EC, line 12, col. c)

$ . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . .

2014

2012

(2012 Sch. EC, line 12, col. c)

$ . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . .

2014–15

2013

(2013 Sch. EC, line 6)

$ . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . .

2014–16

$ . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . .

12

Totals

1

1 2

2