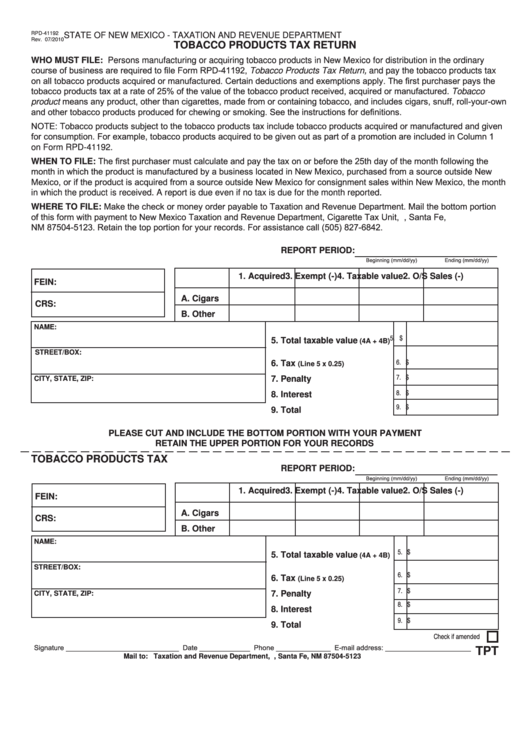

RPD-41192

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

Rev. 07/2010

TOBACCO PRODUCTS TAX RETURN

WHO MUST FILE: Persons manufacturing or acquiring tobacco products in New Mexico for distribution in the ordinary

course of business are required to file Form RPD-41192, Tobacco Products Tax Return, and pay the tobacco products tax

on all tobacco products acquired or manufactured. Certain deductions and exemptions apply. The first purchaser pays the

tobacco products tax at a rate of 25% of the value of the tobacco product received, acquired or manufactured. Tobacco

product means any product, other than cigarettes, made from or containing tobacco, and includes cigars, snuff, roll-your-own

and other tobacco products produced for chewing or smoking. See the instructions for definitions.

NOTE: Tobacco products subject to the tobacco products tax include tobacco products acquired or manufactured and given

for consumption. For example, tobacco products acquired to be given out as part of a promotion are included in Column 1

on Form RPD-41192.

WHEN TO FILE: The first purchaser must calculate and pay the tax on or before the 25th day of the month following the

month in which the product is manufactured by a business located in New Mexico, purchased from a source outside New

Mexico, or if the product is acquired from a source outside New Mexico for consignment sales within New Mexico, the month

in which the product is received. A report is due even if no tax is due for the month reported.

WHERE TO FILE: Make the check or money order payable to Taxation and Revenue Department. Mail the bottom portion

of this form with payment to New Mexico Taxation and Revenue Department, Cigarette Tax Unit, P.O. Box 25123, Santa Fe,

NM 87504-5123. Retain the top portion for your records. For assistance call (505) 827-6842.

REPORT PERIOD:

Beginning (mm/dd/yy)

Ending (mm/dd/yy)

1. Acquired

2. O/S Sales (-)

3. Exempt (-)

4. Taxable value

FEIN:

A. Cigars

CRS:

B. Other

NAME:

5.

$

5. Total taxable value

(4A + 4B)

STREET/BOX:

6.

$

6. Tax

(Line 5 x 0.25)

7.

$

7. Penalty

CITY, STATE, ZIP:

8.

$

8. Interest

9.

$

9. Total

PLEASE CUT AND INCLUDE THE BOTTOM PORTION WITH YOUR PAYMENT

RETAIN THE UPPER PORTION FOR YOUR RECORDS

TOBACCO PRODUCTS TAX

REPORT PERIOD:

Beginning (mm/dd/yy)

Ending (mm/dd/yy)

1. Acquired

2. O/S Sales (-)

3. Exempt (-)

4. Taxable value

FEIN:

A. Cigars

CRS:

B. Other

NAME:

5.

$

5. Total taxable value

(4A + 4B)

STREET/BOX:

6.

$

6. Tax

(Line 5 x 0.25)

7.

$

7. Penalty

CITY, STATE, ZIP:

8.

$

8. Interest

9.

$

9. Total

Check if amended

Signature _____________________________ Date _____________ Phone ______________ E-mail address: ______________________

TPT

Mail to: Taxation and Revenue Department, P.O. Box 25123, Santa Fe, NM 87504-5123

1

1 2

2