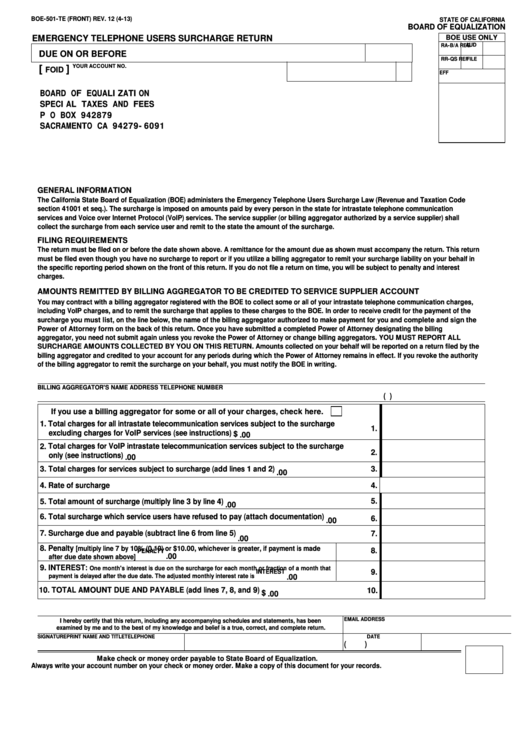

BOE-501-TE (FRONT) REV. 12 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

BOE USE ONLY

EMERGENCY TELEPHONE USERS SURCHARGE RETURN

RA-B/A

AUD

REG

DUE ON OR BEFORE

RR-QS

FILE

REF

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

SPECIAL TAXES AND FEES

P O BOX 942879

SACRAMENTO CA 94279-6091

GENERAL INFORMATION

The California State Board of Equalization (BOE) administers the Emergency Telephone Users Surcharge Law (Revenue and Taxation Code

section 41001 et seq.). The surcharge is imposed on amounts paid by every person in the state for intrastate telephone communication

services and Voice over Internet Protocol (VoIP) services. The service supplier (or billing aggregator authorized by a service supplier) shall

collect the surcharge from each service user and remit to the state the amount of the surcharge.

FILING REQUIREMENTS

The return must be filed on or before the date shown above. A remittance for the amount due as shown must accompany the return. This return

must be filed even though you have no surcharge to report or if you utilize a billing aggregator to remit your surcharge liability on your behalf in

the specific reporting period shown on the front of this return. If you do not file a return on time, you will be subject to penalty and interest

charges.

AMOUNTS REMITTED BY BILLING AGGREGATOR TO BE CREDITED TO SERVICE SUPPLIER ACCOUNT

You may contract with a billing aggregator registered with the BOE to collect some or all of your intrastate telephone communication charges,

including VoIP charges, and to remit the surcharge that applies to these charges to the BOE. In order to receive credit for the payment of the

surcharge you must list, on the line below, the name of the billing aggregator authorized to make payment for you and complete and sign the

Power of Attorney form on the back of this return. Once you have submitted a completed Power of Attorney designating the billing

aggregator, you need not submit again unless you revoke the Power of Attorney or change billing aggregators. YOU MUST REPORT ALL

SURCHARGE AMOUNTS COLLECTED BY YOU ON THIS RETURN. Amounts collected on your behalf will be reported on a return filed by the

billing aggregator and credited to your account for any periods during which the Power of Attorney remains in effect. If you revoke the authority

of the billing aggregator to remit the surcharge on your behalf, you must notify the BOE in writing.

BILLING AGGREGATOR'S NAME

ADDRESS

TELEPHONE NUMBER

(

)

If you use a billing aggregator for some or all of your charges, check here.

1. Total charges for all intrastate telecommunication services subject to the surcharge

1.

excluding charges for VoIP services (see instructions)

$

.00

2. Total charges for VoIP intrastate telecommunication services subject to the surcharge

2.

only (see instructions)

.00

3. Total charges for services subject to surcharge (add lines 1 and 2)

3.

.00

4. Rate of surcharge

4.

5. Total amount of surcharge (multiply line 3 by line 4)

5.

.00

6. Total surcharge which service users have refused to pay (attach documentation)

6.

.00

7. Surcharge due and payable (subtract line 6 from line 5)

7.

.00

8. Penalty

[multiply line 7 by 10% (0.10) or $10.00, whichever is greater, if payment is made

8.

PENALTY

.00

after due date shown above]

9. INTEREST:

One month's interest is due on the surcharge for each month or fraction of a month that

9.

INTEREST

.00

payment is delayed after the due date. The adjusted monthly interest rate is

10. TOTAL AMOUNT DUE AND PAYABLE (add lines 7, 8, and 9)

10.

$

.00

EMAIL ADDRESS

I hereby certify that this return, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

SIGNATURE

PRINT NAME AND TITLE

TELEPHONE

DATE

(

)

Make check or money order payable to State Board of Equalization.

Always write your account number on your check or money order. Make a copy of this document for your records.

1

1 2

2