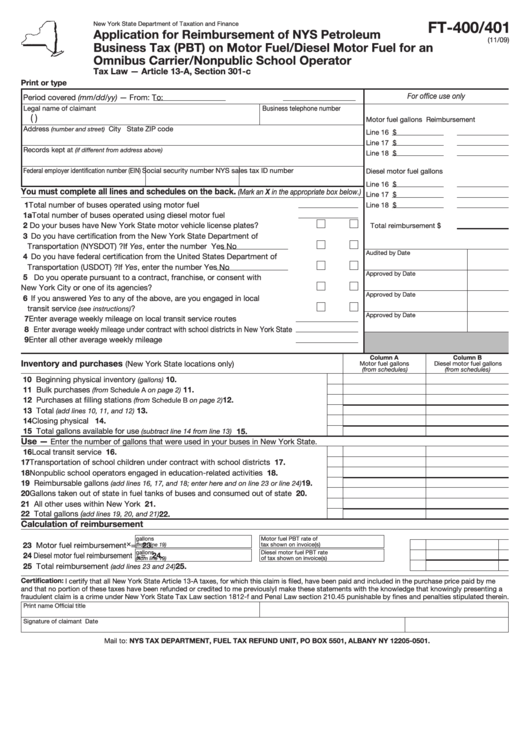

Form Ft-400/401 - Application For Reimbursement Of Nys Petroleum Business Tax (Pbt) On Motor Fuel/diesel Motor Fuel For An Omnibus Carrier-Nonpublic School Operator

ADVERTISEMENT

FT-400/401

New York State Department of Taxation and Finance

Application for Reimbursement of NYS Petroleum

(11/09)

Business Tax (PBT) on Motor Fuel/Diesel Motor Fuel for an

Omnibus Carrier/Nonpublic School Operator

Tax Law — Article 13-A, Section 301-c

Print or type

For office use only

Period covered (mm/dd/yy) — From:

To:

Legal name of claimant

Business telephone number

(

)

Motor fuel gallons

Reimbursement

Address

City

State

ZIP code

(number and street)

Line 16

$

Line 17

$

Records kept at

(if different from address above)

Line 18

$

Federal employer identification number (EIN)

Social security number

NYS sales tax ID number

Diesel motor fuel gallons

Line 16

$

You must complete all lines and schedules on the back.

(Mark an X in the appropriate box below.)

Line 17

$

1 Total number of buses operated using motor fuel ......................................

Line 18

$

1a Total number of buses operated using diesel motor fuel .............................

2 Do your buses have New York State motor vehicle license plates? ............

Yes

No

Total reimbursement

$

3 Do you have certification from the New York State Department of

Transportation (NYSDOT) ? If Yes, enter the number

Yes

No

Audited by

Date

4 Do you have federal certification from the United States Department of

Transportation (USDOT) ? If Yes, enter the number

Yes

No

Approved by

Date

5 Do you operate pursuant to a contract, franchise, or consent with

New York City or one of its agencies? ......................................................

Yes

No

Approved by

Date

6 If you answered Yes to any of the above, are you engaged in local

transit service

? .................................................................

Yes

No

(see instructions)

Approved by

Date

7 Enter average weekly mileage on local transit service routes .....................

8 Enter average weekly mileage under contract with school districts in New York State

9 Enter all other average weekly mileage .......................................................

Column A

Column B

Inventory and purchases

(New York State locations only)

Motor fuel gallons

Diesel motor fuel gallons

(from schedules)

(from schedules)

10 Beginning physical inventory

........................................................................... 10.

(gallons)

11 Bulk purchases

................................................................... 11.

(from Schedule A on page 2)

12 Purchases at filling stations

................................................ 12.

(from Schedule B on page 2)

13 Total

......................................................................................... 13.

(add lines 10, 11, and 12)

14 Closing physical inventory............................................................................................ 14.

15 Total gallons available for use

............................................ 15.

(subtract line 14 from line 13)

Use —

Enter the number of gallons that were used in your buses in New York State.

16 Local transit service ..................................................................................................... 16.

17 Transportation of school children under contract with school districts ....................... 17.

18 Nonpublic school operators engaged in education-related activities .......................... 18.

19 Reimbursable gallons

........... 19.

(add lines 16, 17, and 18; enter here and on line 23 or line 24)

20 Gallons taken out of state in fuel tanks of buses and consumed out of state ............. 20.

21 All other uses within New York State............................................................................ 21.

22 Total gallons (

............................................................................. 22.

add lines 19, 20, and 21)

Calculation of reimbursement

gallons

Motor fuel PBT rate of

×

23 Motor fuel reimbursement

= .... 23.

tax shown on invoice(s)

(from line 19)

gallons

Diesel motor fuel PBT rate

24 Diesel motor fuel reimbursement

= .... 24.

×

of tax shown on invoice(s)

(from line 19)

25 Total reimbursement

............................................................................................................ 25.

(add lines 23 and 24)

Certification: I certify that all New York State Article 13-A taxes, for which this claim is filed, have been paid and included in the purchase price paid by me

and that no portion of these taxes have been refunded or credited to me previously. I make these statements with the knowledge that knowingly presenting a

fraudulent claim is a crime under New York State Tax Law section 1812-f and Penal Law section 210.45 punishable by fines and penalties stipulated therein.

Print name

Official title

Signature of claimant

Date

Mail to: NYS TAX DEPARTMENT, FUEL TAX REFUND UNIT, PO BOX 5501, ALBANY NY 12205-0501.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2