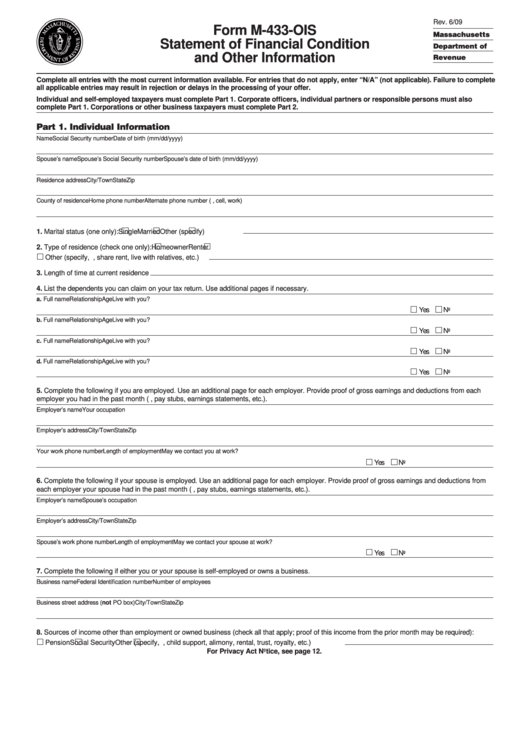

Form M-433-Ois - Statement Of Financial Condition And Other Information

ADVERTISEMENT

Rev. 6/09

Form M-433-OIS

Massachusetts

Statement of Financial Condition

Department of

and Other Information

Revenue

Complete all entries with the most current information available. For entries that do not apply, enter “N/A” (not applicable). Failure to complete

all applicable entries may result in rejection or delays in the processing of your offer.

Individual and self-employed taxpayers must complete Part 1. Corporate officers, individual partners or responsible persons must also

complete Part 1. Corporations or other business taxpayers must complete Part 2.

Part 1. Individual Information

Name

Social Security number

Date of birth (mm/dd/yyyy)

Spouse’s name

Spouse’s Social Security number

Spouse’s date of birth (mm/dd/yyyy)

Residence address

City/Town

State

Zip

County of residence

Home phone number

Alternate phone number (e.g., cell, work)

1. Marital status (one only):

Single

Married

Other (specify)

2. Type of residence (check one only):

Homeowner

Renter

Other (specify, e.g., share rent, live with relatives, etc.)

3. Length of time at current residence

4. List the dependents you can claim on your tax return. Use additional pages if necessary.

a. Full name

Relationship

Age

Live with you?

Yes

No

b. Full name

Relationship

Age

Live with you?

Yes

No

c. Full name

Relationship

Age

Live with you?

Yes

No

d. Full name

Relationship

Age

Live with you?

Yes

No

5. Complete the following if you are employed. Use an additional page for each employer. Provide proof of gross earnings and deductions from each

employer you had in the past month (e.g., pay stubs, earnings statements, etc.).

Employer’s name

Your occupation

Employer’s address

City/Town

State

Zip

Your work phone number

Length of employment

May we contact you at work?

Yes

No

6. Complete the following if your spouse is employed. Use an additional page for each employer. Provide proof of gross earnings and deductions from

each employer your spouse had in the past month (e.g., pay stubs, earnings statements, etc.).

Employer’s name

Spouse’s occupation

Employer’s address

City/Town

State

Zip

Spouse’s work phone number

Length of employment

May we contact your spouse at work?

Yes

No

7. Complete the following if either you or your spouse is self-employed or owns a business.

Business name

Federal Identification number

Number of employees

Business street address (not PO box)

City/Town

State

Zip

8. Sources of income other than employment or owned business (check all that apply; proof of this income from the prior month may be required):

Pension

Social Security

Other (specify, e.g., child support, alimony, rental, trust, royalty, etc.)

For Privacy Act Notice, see page 12.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12