Form Asd-22240 - Application For Resident Contractor Certification

ADVERTISEMENT

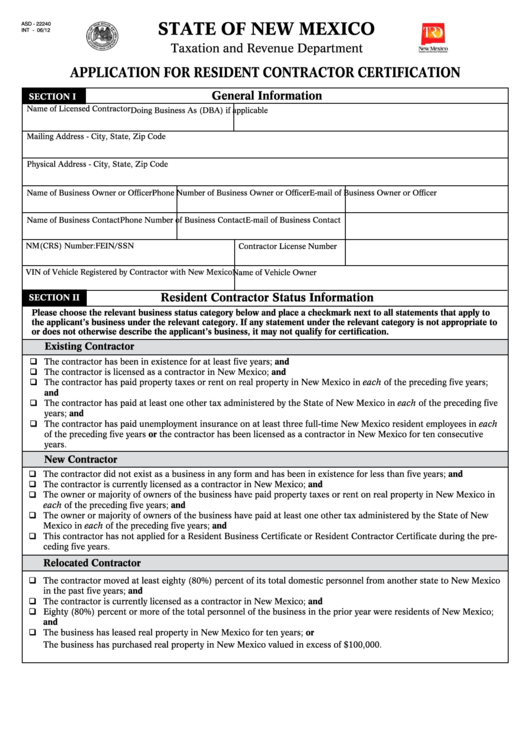

STATE OF NEW MEXICO

ASD - 22240

INT - 06/12

Taxation and Revenue Department

APPLICATION FOR RESIDENT CONTRACTOR CERTIFICATION

General Information

SECTION I

Name of Licensed Contractor

Doing Business As (DBA) if applicable

Mailing Address - City, State, Zip Code

Physical Address - City, State, Zip Code

Name of Business Owner or Officer

Phone Number of Business Owner or Officer

E-mail of Business Owner or Officer

Name of Business Contact

Phone Number of Business Contact

E-mail of Business Contact

NM(CRS) Number:

FEIN/SSN

Contractor License Number

VIN of Vehicle Registered by Contractor with New Mexico

Name of Vehicle Owner

Resident Contractor Status Information

SECTION II

Please choose the relevant business status category below and place a checkmark next to all statements that apply to

the applicant’s business under the relevant category. If any statement under the relevant category is not appropriate to

or does not otherwise describe the applicant’s business, it may not qualify for certification.

Existing Contractor

The contractor has been in existence for at least five years; and

q

The contractor is licensed as a contractor in New Mexico; and

q

The contractor has paid property taxes or rent on real property in New Mexico in each of the preceding five years;

q

and

The contractor has paid at least one other tax administered by the State of New Mexico in each of the preceding five

q

years; and

The contractor has paid unemployment insurance on at least three full-time New Mexico resident employees in each

q

of the preceding five years or the contractor has been licensed as a contractor in New Mexico for ten consecutive

years.

New Contractor

The contractor did not exist as a business in any form and has been in existence for less than five years; and

q

The contractor is currently licensed as a contractor in New Mexico; and

q

The owner or majority of owners of the business have paid property taxes or rent on real property in New Mexico in

q

each of the preceding five years; and

The owner or majority of owners of the business have paid at least one other tax administered by the State of New

q

Mexico in each of the preceding five years; and

This contractor has not applied for a Resident Business Certificate or Resident Contractor Certificate during the pre-

q

ceding five years.

Relocated Contractor

The contractor moved at least eighty (80%) percent of its total domestic personnel from another state to New Mexico

q

in the past five years; and

The contractor is currently licensed as a contractor in New Mexico; and

q

Eighty (80%) percent or more of the total personnel of the business in the prior year were residents of New Mexico;

q

and

The business has leased real property in New Mexico for ten years; or

q

The business has purchased real property in New Mexico valued in excess of $100,000.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4