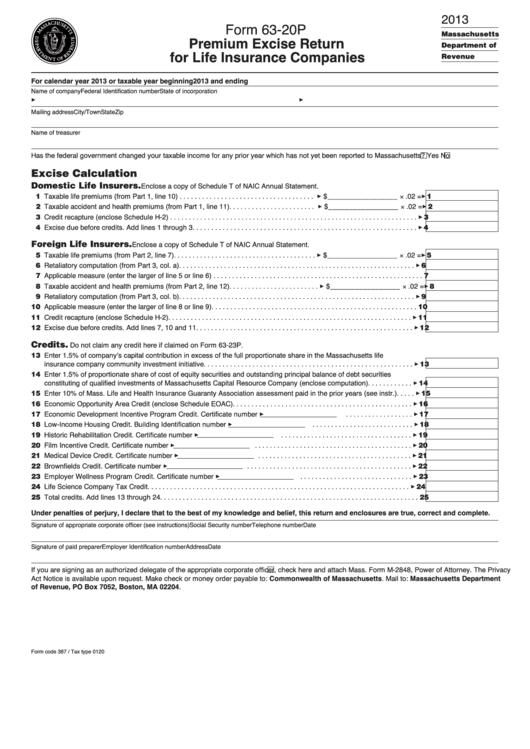

2013

Form 63-20P

Premium Excise Return

for Life Insurance Companies

Massachusetts

Department of

Revenue

For calendar year 2013 or taxable year beginning

2013 and ending

Name of company

Federal Identification number

State of incorporation

3

3

Mailing address

City/Town

State

Zip

Name of treasurer

Has the federal government changed your taxable income for any prior year which has not yet been reported to Massachusetts?

Yes

No

Excise Calculation

Enclose a copy of Schedule T of NAIC Annual Statement.

Domestic Life Insurers.

11 Taxable life premiums (from Part 1, line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 $_________________ × .02 = 3 1

12 Taxable accident and health premiums (from Part 1, line 11). . . . . . . . . . . . . . . . . . . . . . . 3 $_________________ × .02 = 3 2

13 Credit recapture (enclose Schedule H-2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

14 Excise due before credits. Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

Enclose a copy of Schedule T of NAIC Annual Statement.

Foreign Life Insurers.

15 Taxable life premiums (from Part 2, line 7). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 $_________________ × .02 = 3 5

16 Retaliatory computation (from Part 3, col. a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

17 Applicable measure (enter the larger of line 5 or line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18 Taxable accident and health premiums (from Part 2, line 12) . . . . . . . . . . . . . . . . . . . . . . . . 3 $_________________ × .02 = 3 8

19 Retaliatory computation (from Part 3, col. b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 9

10 Applicable measure (enter the larger of line 8 or line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Credit recapture (enclose Schedule H-2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 11

12 Excise due before credits. Add lines 7, 10 and 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

Do not claim any credit here if claimed on Form 63-23P.

Credits.

13 Enter 1.5% of company’s capital contribution in excess of the full proportionate share in the Massachusetts life

insurance company community investment initiative . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 13

14 Enter 1.5% of proportionate share of cost of equity securities and outstanding principal balance of debt securities

constituting of qualified investments of Massachusetts Capital Resource Company (enclose computation) . . . . . . . . . . . . 3 14

15 Enter 10% of Mass. Life and Health Insurance Guaranty Association assessment paid in the prior years (see instr.) . . . . . 3 15

16 Economic Opportunity Area Credit (enclose Schedule EOAC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 16

17 Economic Development Incentive Program Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . 3 17

18 Low-Income Housing Credit. Building Identification number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . 3 18

19 Historic Rehabilitation Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 19

20 Film Incentive Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 20

21 Medical Device Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 21

22 Brownfields Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 22

23 Employer Wellness Program Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 23

24 Life Science Company Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 24

25 Total credits. Add lines 13 through 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Under penalties of perjury, I declare that to the best of my knowledge and belief, this return and enclosures are true, correct and complete.

Signature of appropriate corporate officer (see instructions)

Social Security number

Telephone number

Date

Signature of paid preparer

Employer Identification number

Address

Date

If you are signing as an authorized delegate of the appropriate corporate officer,

check here and attach Mass. Form M-2848, Power of Attorney. The Privacy

Act Notice is available upon request. Make check or money order payable to: Commonwealth of Massachusetts. Mail to: Massachusetts Department

of Revenue, PO Box 7052, Boston, MA 02204.

Form code 387 / Tax type 0120

1

1 2

2 3

3