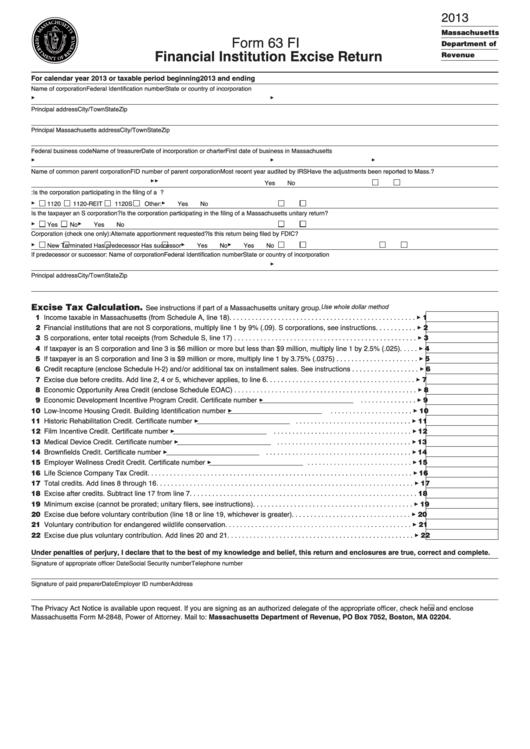

2013

Form 63 FI

Financial Institution Excise Return

Massachusetts

Department of

Revenue

For calendar year 2013 or taxable period beginning

2013 and ending

Name of corporation

Federal Identification number

State or country of incorporation

3

3

Principal address

City/Town

State

Zip

Principal Massachusetts address

City/Town

State

Zip

Federal business code

Name of treasurer

Date of incorporation or charter

First date of business in Massachusetts

3

3

3

Name of common parent corporation

FID number of parent corporation

Most recent year audited by IRS

Have the adjustments been reported to Mass.?

Yes

No

3

3

U.S. return filed:

Is the corporation participating in the filing of a U.S. consolidated return?

1120

1120-REIT

1120S

Other:

Yes

No

Is the taxpayer an S corporation?

Is the corporation participating in the filing of a Massachusetts unitary return?

3

3

Yes

No

Yes

No

3

Corporation (check one only):

3

Alternate apportionment requested?

Is this return being filed by FDIC?

New

Terminated

Has predecessor

Has successor

Yes

No

Yes

No

3

If predecessor or successor: Name of corporation

3

Federal Identification number

3

State or country of incorporation

3

Principal address

City/Town

State

Zip

See instructions if part of a Massachusetts unitary group.

Excise Tax Calculation.

1 Income taxable in Massachusetts (from Schedule A, line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

Use whole dollar method

2 Financial institutions that are not S corporations, multiply line 1 by 9% (.09). S corporations, see instructions . . . . . . . . . . . 3 2

3 S corporations, enter total receipts (from Schedule S, line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

4 If taxpayer is an S corporation and line 3 is $6 million or more but less than $9 million, multiply line 1 by 2.5% (.025) . . . . . 3 4

5 If taxpayer is an S corporation and line 3 is $9 million or more, multiply line 1 by 3.75% (.0375) . . . . . . . . . . . . . . . . . . . . . . 3 5

6 Credit recapture (enclose Schedule H-2) and/or additional tax on installment sales. See instructions . . . . . . . . . . . . . . . . . . 3 6

7 Excise due before credits. Add line 2, 4 or 5, whichever applies, to line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 7

8 Economic Opportunity Area Credit (enclose Schedule EOAC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

9 Economic Development Incentive Program Credit. Certificate number 3

. . . . . . . . . . . . . . . 3 9

10 Low-Income Housing Credit. Building Identification number 3

. . . . . . . . . . . . . . . . . . . . . . 3 10

11 Historic Rehabilitation Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 11

12 Film Incentive Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

13 Medical Device Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 13

14 Brownfields Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 Employer Wellness Credit Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 15

16 Life Science Company Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 16

17 Total credits. Add lines 8 through 16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 17

18 Excise after credits. Subtract line 17 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Minimum excise (cannot be prorated; unitary filers, see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 19

20 Excise due before voluntary contribution (line 18 or line 19, whichever is greater) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 20

21 Voluntary contribution for endangered wildlife conservation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 21

22 Excise due plus voluntary contribution. Add lines 20 and 21. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 22

Under penalties of perjury, I declare that to the best of my knowledge and belief, this return and enclosures are true, correct and complete.

Signature of appropriate officer

Date

Social Security number

Telephone number

Signature of paid preparer

Date

Employer ID number

Address

The Privacy Act Notice is available upon request. If you are signing as an authorized delegate of the appropriate officer, check here

and enclose

Massachusetts Form M-2848, Power of Attorney. Mail to: Massachusetts Department of Revenue, PO Box 7052, Boston, MA 02204.

1

1 2

2 3

3 4

4