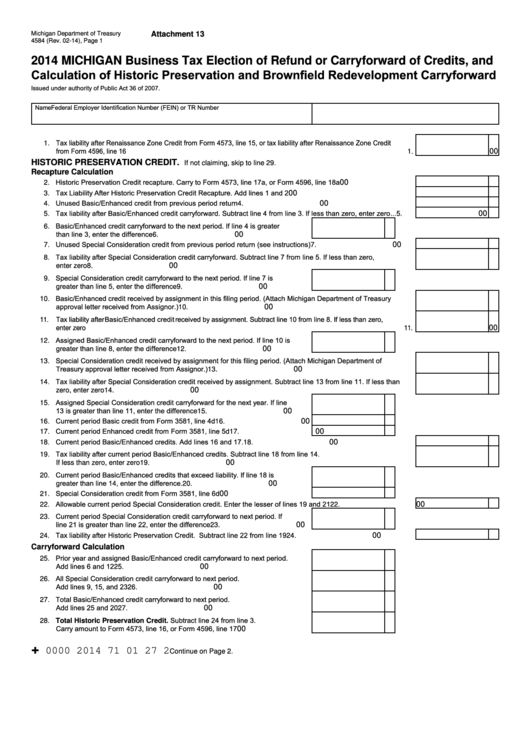

Form 4584 - Michigan Business Tax Election Of Refund Or Carryforward Of Credits, And Calculation Of Historic Preservation And Brownfield Redevelopment Carryforward - 2014

ADVERTISEMENT

Michigan Department of Treasury

Attachment 13

4584 (Rev. 02-14), Page 1

2014 MICHIGAN Business Tax Election of Refund or Carryforward of Credits, and

Calculation of Historic Preservation and Brownfield Redevelopment Carryforward

Issued under authority of Public Act 36 of 2007.

Name

Federal Employer Identification Number (FEIN) or TR Number

1. Tax liability after Renaissance Zone Credit from Form 4573, line 15, or tax liability after Renaissance Zone Credit

from Form 4596, line 16 ....................................................................................................................................................

00

1.

HISTORIC PRESERVATION CREDIT.

If not claiming, skip to line 29.

Recapture Calculation

2. Historic Preservation Credit recapture. Carry to Form 4573, line 17a, or Form 4596, line 18a.............................

00

2.

3. Tax Liability After Historic Preservation Credit Recapture. Add lines 1 and 2........................................................

00

3.

4. Unused Basic/Enhanced credit from previous period return .................................................................................

00

4.

5. Tax liability after Basic/Enhanced credit carryforward. Subtract line 4 from line 3. If less than zero, enter zero ...

00

5.

6. Basic/Enhanced credit carryforward to the next period. If line 4 is greater

than line 3, enter the difference .......................................................................

00

6.

7. Unused Special Consideration credit from previous period return (see instructions) ............................................

00

7.

8. Tax liability after Special Consideration credit carryforward. Subtract line 7 from line 5. If less than zero,

00

enter zero ..............................................................................................................................................................

8.

9. Special Consideration credit carryforward to the next period. If line 7 is

greater than line 5, enter the difference ...........................................................

00

9.

10. Basic/Enhanced credit received by assignment in this filing period. (Attach Michigan Department of Treasury

approval letter received from Assignor.) ................................................................................................................

00

10.

11. Tax liability after Basic/Enhanced credit received by assignment. Subtract line 10 from line 8. If less than zero,

00

enter zero ........................................................................................................................................................................

11.

12. Assigned Basic/Enhanced credit carryforward to the next period. If line 10 is

greater than line 8, enter the difference ...........................................................

00

12.

13. Special Consideration credit received by assignment for this filing period. (Attach Michigan Department of

Treasury approval letter received from Assignor.) .................................................................................................

00

13.

14. Tax liability after Special Consideration credit received by assignment. Subtract line 13 from line 11. If less than

00

zero, enter zero .....................................................................................................................................................

14.

15. Assigned Special Consideration credit carryforward for the next year. If line

13 is greater than line 11, enter the difference ................................................

00

15.

16. Current period Basic credit from Form 3581, line 4d .......................................

00

16.

17. Current period Enhanced credit from Form 3581, line 5d ...............................

00

17.

18. Current period Basic/Enhanced credits. Add lines 16 and 17. ..............................................................................

00

18.

19. Tax liability after current period Basic/Enhanced credits. Subtract line 18 from line 14.

00

If less than zero, enter zero ...................................................................................................................................

19.

20. Current period Basic/Enhanced credits that exceed liability. If line 18 is

greater than line 14, enter the difference. ........................................................

00

20.

21. Special Consideration credit from Form 3581, line 6d.....................................

00

21.

22. Allowable current period Special Consideration credit. Enter the lesser of lines 19 and 21 .................................

00

22.

23. Current period Special Consideration credit carryforward to next period. If

line 21 is greater than line 22, enter the difference .........................................

00

23.

24. Tax liability after Historic Preservation Credit. Subtract line 22 from line 19 ........................................................

00

24.

Carryforward Calculation

25. Prior year and assigned Basic/Enhanced credit carryforward to next period.

Add lines 6 and 12 ...........................................................................................

00

25.

26. All Special Consideration credit carryforward to next period.

Add lines 9, 15, and 23 ....................................................................................

00

26.

27. Total Basic/Enhanced credit carryforward to next period.

Add lines 25 and 20 .........................................................................................

00

27.

28. Total Historic Preservation Credit. Subtract line 24 from line 3.

Carry amount to Form 4573, line 16, or Form 4596, line 17............................

00

28.

+

0000 2014 71 01 27 2

Continue on Page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9