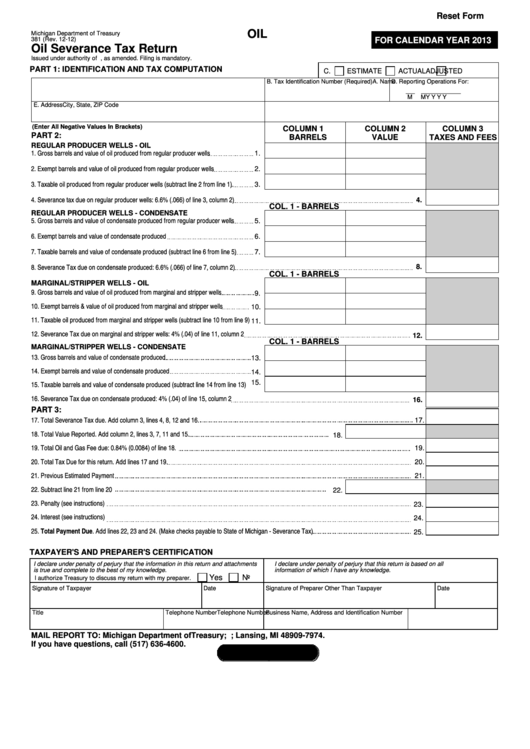

Reset Form

OIL

Michigan Department of Treasury

FOR CALENDAR YEAR 2013

381 (Rev. 12-12)

Oil Severance Tax Return

Issued under authority of P.A. 48 of 1929, as amended. Filing is mandatory.

PART 1: IDENTIFICATION AND TAX COMPUTATION

C.

ESTIMATE

ACTUAL

ADJUSTED

A. Name

B. Tax Identification Number (Required)

D. Reporting Operations For:

__ __

_______

M

M

Y Y Y Y

E. Address

City, State, ZIP Code

(Enter All Negative Values In Brackets)

COLUMN 1

COLUMN 2

COLUMN 3

PART 2:

BARRELS

VALUE

TAXES AND FEES

REGULAR PRODUCER WELLS - OIL

1. Gross barrels and value of oil produced from regular producer wells

1.

2. Exempt barrels and value of oil produced from regular producer wells

2.

3. Taxable oil produced from regular producer wells (subtract line 2 from line 1).

3.

4. Severance tax due on regular producer wells: 6.6% (.066) of line 3, column 2)

4.

COL. 1 - BARRELS

REGULAR PRODUCER WELLS - CONDENSATE

5. Gross barrels and value of condensate produced from regular producer wells

5.

6. Exempt barrels and value of condensate produced

6.

7. Taxable barrels and value of condensate produced (subtract line 6 from line 5)

7.

8. Severance Tax due on condensate produced: 6.6% (.066) of line 7, column 2)

8.

COL. 1 - BARRELS

MARGINAL/STRIPPER WELLS - OIL

9. Gross barrels and value of oil produced from marginal and stripper wells

9.

10. Exempt barrels & value of oil produced from marginal and stripper wells

10.

11. Taxable oil produced from marginal and stripper wells (subtract line 10 from line 9)

11.

12. Severance Tax due on marginal and stripper wells: 4% (.04) of line 11, column 2

12.

COL. 1 - BARRELS

MARGINAL/STRIPPER WELLS - CONDENSATE

13. Gross barrels and value of condensate produced

13.

14. Exempt barrels and value of condensate produced

14.

15. Taxable barrels and value of condensate produced (subtract line 14 from line 13)

15.

16. Severance Tax due on condensate produced: 4% (.04) of line 15, column 2

16.

PART 3:

17. Total Severance Tax due. Add column 3, lines 4, 8, 12 and 16.

17.

18. Total Value Reported. Add column 2, lines 3, 7, 11 and 15.

18.

19. Total Oil and Gas Fee due: 0.84% (0.0084) of line 18.

19.

20. Total Tax Due for this return. Add lines 17 and 19.

20.

21. Previous Estimated Payment

21.

22. Subtract line 21 from line 20

22.

23. Penalty (see instructions)

23.

24. Interest (see instructions)

24.

25. Total Payment Due. Add lines 22, 23 and 24. (Make checks payable to State of Michigan - Severance Tax)

25.

TAXPAYER'S AND PREPARER'S CERTIFICATION

I declare under penalty of perjury that the information in this return and attachments

I declare under penalty of perjury that this return is based on all

is true and complete to the best of my knowledge.

information of which I have any knowledge.

Yes

No

I authorize Treasury to discuss my return with my preparer.

Signature of Taxpayer

Date

Signature of Preparer Other Than Taxpayer

Date

Title

Telephone Number

Business Name, Address and Identification Number

Telephone Number

MAIL REPORT TO: Michigan Department of Treasury; P.O. Box 30474; Lansing, MI 48909-7974.

If you have questions, call (517) 636-4600.

n.gov /taxes

1

1 2

2 3

3 4

4