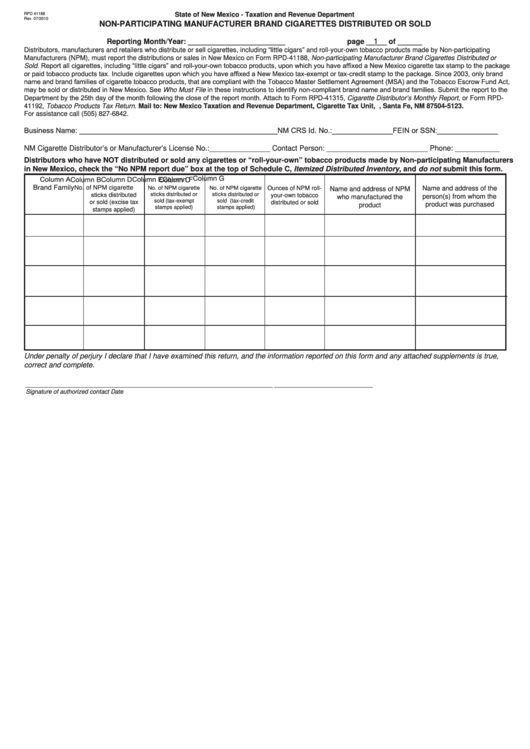

Form Rpd-41188 - Non-Participating Manufacturer Brand Cigarettes Distributed Or Sold

ADVERTISEMENT

RPD 41188

State of New Mexico - Taxation and Revenue Department

Rev. 07/2010

NON-PARTICIPATING MANUFACTURER BRAND CIGARETTES DISTRIBUTED OR SOLD

1

Reporting Month/Year: ________________________

page _____ of ______

Distributors, manufacturers and retailers who distribute or sell cigarettes, including “little cigars” and roll-your-own tobacco products made by Non-participating

Manufacturers (NPM), must report the distributions or sales in New Mexico on Form RPD-41188, Non-participating Manufacturer Brand Cigarettes Distributed or

Sold. Report all cigarettes, including “little cigars” and roll-your-own tobacco products, upon which you have affixed a New Mexico cigarette tax stamp to the package

or paid tobacco products tax. Include cigarettes upon which you have affixed a New Mexico tax-exempt or tax-credit stamp to the package. Since 2003, only brand

name and brand families of cigarette tobacco products, that are compliant with the Tobacco Master Settlement Agreement (MSA) and the Tobacco Escrow Fund Act,

may be sold or distributed in New Mexico. See Who Must File in these instructions to identify non-compliant brand name and brand families. Submit the report to the

Department by the 25th day of the month following the close of the report month. Attach to Form RPD-41315, Cigarette Distributor’s Monthly Report, or Form RPD-

41192, Tobacco Products Tax Return. Mail to: New Mexico Taxation and Revenue Department, Cigarette Tax Unit, P.O. Box 25123, Santa Fe, NM 87504-5123.

For assistance call (505) 827-6842.

Business Name: _________________________________________________NM CRS Id. No.:_______________FEIN or SSN:_______________

NM Cigarette Distributor’s or Manufacturer’s License No.:_______________ Contact Person: _________________________ Phone: ___________

Distributors who have NOT distributed or sold any cigarettes or “roll-your-own” tobacco products made by Non-participating Manufacturers

in New Mexico, check the “No NPM report due” box at the top of Schedule C, Itemized Distributed Inventory, and do not submit this form.

Column A

Column E

Column G

Column B

Column D

Column F

Column C

Brand Family

No. of NPM cigarette

No. of NPM cigarette

No. of NPM cigarette

Ounces of NPM roll-

Name and address of the

Name and address of NPM

sticks distributed

sticks distributed or

sticks distributed or

your-own tobacco

person(s) from whom the

who manufactured the

sold (tax-exempt

sold (tax-credit

or sold (excise tax

distributed or sold

product was purchased

product

stamps applied)

stamps applied)

stamps applied)

Under penalty of perjury I declare that I have examined this return, and the information reported on this form and any attached supplements is true,

correct and complete.

_________________________________________________________________________

_____________________________

Signature of authorized contact

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3