Form Ct-1120fp - Film Production Tax Credit - 2013

ADVERTISEMENT

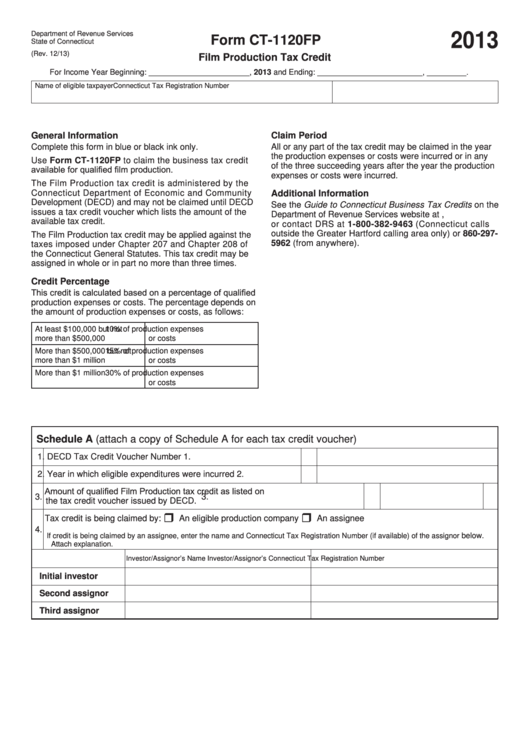

Department of Revenue Services

2013

Form CT-1120FP

State of Connecticut

(Rev. 12/13)

Film Production Tax Credit

For Income Year Beginning: _______________________ , 2013 and Ending: ________________________ , _________ .

Name of eligible taxpayer

Connecticut Tax Registration Number

General Information

Claim Period

Complete this form in blue or black ink only.

All or any part of the tax credit may be claimed in the year

the production expenses or costs were incurred or in any

Use Form CT-1120FP to claim the business tax credit

of the three succeeding years after the year the production

available for qualified film production.

expenses or costs were incurred.

The Film Production tax credit is administered by the

Connecticut Department of Economic and Community

Additional Information

Development (DECD) and may not be claimed until DECD

See the Guide to Connecticut Business Tax Credits on the

issues a tax credit voucher which lists the amount of the

Department of Revenue Services website at ,

available tax credit.

or contact DRS at 1-800-382-9463 (Connecticut calls

outside the Greater Hartford calling area only) or 860-297-

The Film Production tax credit may be applied against the

5962 (from anywhere).

taxes imposed under Chapter 207 and Chapter 208 of

the Connecticut General Statutes. This tax credit may be

assigned in whole or in part no more than three times.

Credit Percentage

This credit is calculated based on a percentage of qualified

production expenses or costs. The percentage depends on

the amount of production expenses or costs, as follows:

At least $100,000 but not

10% of production expenses

more than $500,000

or costs

More than $500,000 but not

15% of production expenses

more than $1 million

or costs

More than $1 million

30% of production expenses

or costs

Schedule A (attach a copy of Schedule A for each tax credit voucher)

1. DECD Tax Credit Voucher Number

1.

2. Year in which eligible expenditures were incurred

2.

Amount of qualified Film Production tax credit as listed on

3.

3.

the tax credit voucher issued by DECD.

Tax credit is being claimed by:

An eligible production company

An assignee

4.

below.

If credit is being claimed by an assignee, enter the name and Connecticut Tax Registration Number (if available) of the assignor

Attach explanation.

Investor/Assignor’s Name

Investor/Assignor’s Connecticut Tax Registration Number

Initial investor

Second assignor

Third assignor

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2