Payroll And Earnings Statement

ADVERTISEMENT

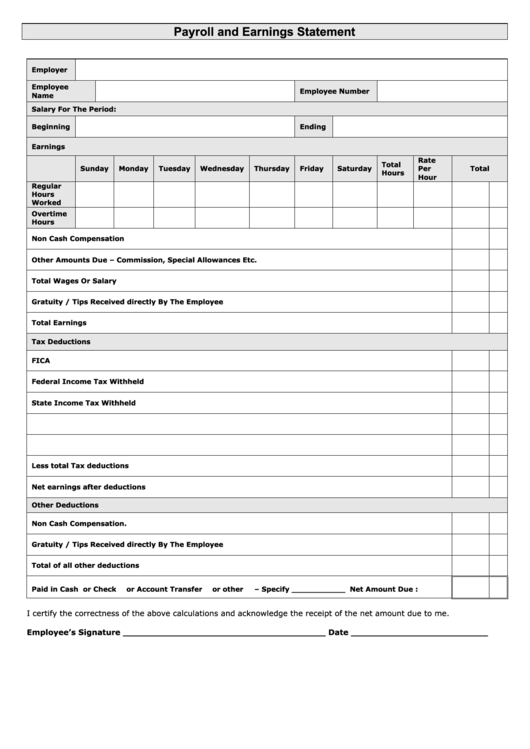

Payroll and Earnings Statement

Employer

Employee

Employee Number

Name

Salary For The Period:

Beginning

Ending

Earnings

Rate

Total

Sunday

Monday

Tuesday

Wednesday

Thursday

Friday

Saturday

Per

Total

Hours

Hour

Regular

Hours

Worked

Overtime

Hours

Non Cash Compensation

Other Amounts Due – Commission, Special Allowances Etc.

Total Wages Or Salary

Gratuity / Tips Received directly By The Employee

Total Earnings

Tax Deductions

FICA

Federal Income Tax Withheld

State Income Tax Withheld

Less total Tax deductions

Net earnings after deductions

Other Deductions

Non Cash Compensation.

Gratuity / Tips Received directly By The Employee

Total of all other deductions

Paid in Cash

or Check

or Account Transfer

or other

– Specify ___________ Net Amount Due :

I certify the correctness of the above calculations and acknowledge the receipt of the net amount due to me.

Employee’s Signature _____________________________________ Date _________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1