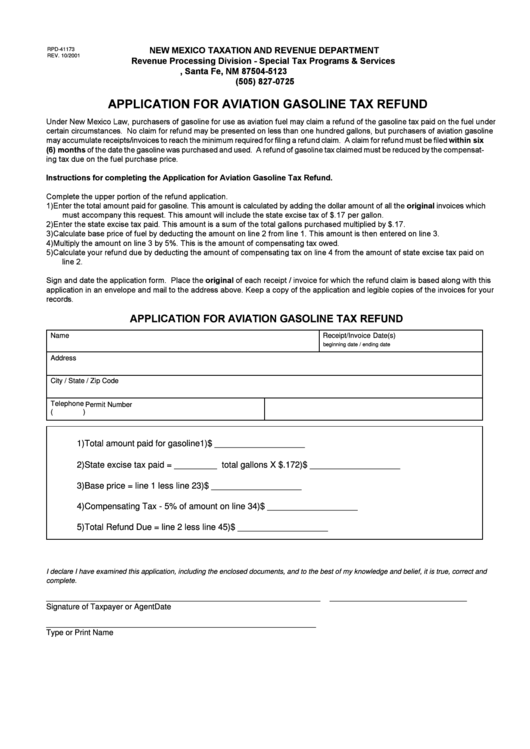

NEW MEXICO TAXATION AND REVENUE DEPARTMENT

RPD-41173

REV. 10/2001

Revenue Processing Division - Special Tax Programs & Services

P.O. Box 25123, Santa Fe, NM 87504-5123

(505) 827-0725

APPLICATION FOR AVIATION GASOLINE TAX REFUND

Under New Mexico Law, purchasers of gasoline for use as aviation fuel may claim a refund of the gasoline tax paid on the fuel under

certain circumstances. No claim for refund may be presented on less than one hundred gallons, but purchasers of aviation gasoline

may accumulate receipts/invoices to reach the minimum required for filing a refund claim. A claim for refund must be filed within six

(6) months of the date the gasoline was purchased and used. A refund of gasoline tax claimed must be reduced by the compensat-

ing tax due on the fuel purchase price.

Instructions for completing the Application for Aviation Gasoline Tax Refund.

Complete the upper portion of the refund application.

1)

Enter the total amount paid for gasoline. This amount is calculated by adding the dollar amount of all the original invoices which

must accompany this request. This amount will include the state excise tax of $.17 per gallon.

2)

Enter the state excise tax paid. This amount is a sum of the total gallons purchased multiplied by $.17.

3)

Calculate base price of fuel by deducting the amount on line 2 from line 1. This amount is then entered on line 3.

4)

Multiply the amount on line 3 by 5%. This is the amount of compensating tax owed.

5)

Calculate your refund due by deducting the amount of compensating tax on line 4 from the amount of state excise tax paid on

line 2.

Sign and date the application form. Place the original of each receipt / invoice for which the refund claim is based along with this

application in an envelope and mail to the address above. Keep a copy of the application and legible copies of the invoices for your

records.

APPLICATION FOR AVIATION GASOLINE TAX REFUND

Name

Receipt/Invoice Date(s)

beginning date / ending date

Address

City / State / Zip Code

Telephone

Permit Number

(

)

1) Total amount paid for gasoline

1)

$ ___________________

2) State excise tax paid = _________ total gallons X $.17

2)

$ ___________________

3) Base price = line 1 less line 2

3)

$ ___________________

4) Compensating Tax - 5% of amount on line 3

4)

$ ___________________

5) Total Refund Due = line 2 less line 4

5)

$ ___________________

I declare I have examined this application, including the enclosed documents, and to the best of my knowledge and belief, it is true, correct and

complete.

______________________________________________________________

_______________________________

Signature of Taxpayer or Agent

Date

_____________________________________________________________

Type or Print Name

1

1