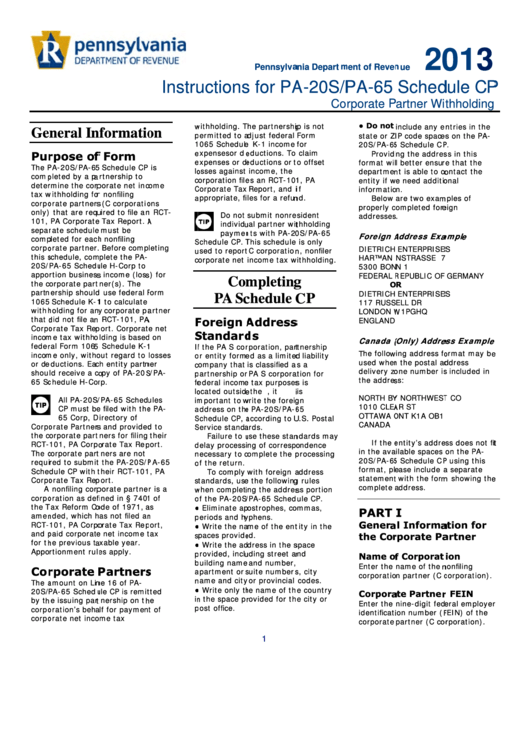

Instructions For Form Pa-20s/pa 65 - Schedule Cp - Corporate Partner Withholding - 2013

ADVERTISEMENT

20

013

Pennsylva

ania Departm

ment of Reven

nue

Instru

uctions

s for PA

A-20S/P

PA-65

Sched

dule CP

P

Co

rporate P

Partner Wi

thholding

w

withholding. T

he partnership

p is not

●

Do not

include any e

ntries in the

Ge

neral In

formatio

on

p

permitted to a

djust federal

Form

state or ZI

IP code space

es on the PA-

1

1065 Schedule

e K-1 income

for

20S/PA-65

5 Schedule CP

P.

e

expenses or de

eductions. To

claim

Pur

rpose of

f Form

Providi

ing the addres

ss in this

e

expenses or de

eductions or t

to offset

format wil

l better ensur

re that the

The P

PA-20S/PA-65

5 Schedule CP

is

lo

osses against

income, the

departmen

nt is able to co

ontact the

comp

pleted by a pa

rtnership to

c

corporation file

es an RCT-101

1, PA

entity if w

e need additio

onal

deter

rmine the corp

porate net inc

come

C

Corporate Tax

Report, and i

if

informatio

on.

tax w

withholding for

r nonfiling

a

appropriate, fi

les for a refun

nd.

Below

are two exam

mples of

corpo

orate partners

s (C corporatio

ons

properly c

ompleted fore

eign

only)

that are requ

uired to file an

n RCT-

Do not

submit nonre

sident

addresses

.

101,

PA Corporate

Tax Report. A

A

individu

ual partner wit

thholding

separ

rate schedule

must be

paymen

nts with PA-20

0S/PA-65

Foreign A

Address Exa

ample

comp

pleted for each

h nonfiling

S

Schedule CP. T

This schedule

is only

corpo

orate partner.

Before comp

leting

DIETRICH

ENTERPRISES

S

u

used to report

C corporation

n, nonfiler

this s

schedule, com

mplete the PA-

HARTMAN

NSTRASSE 7

c

corporate net

income tax w

ithholding.

20S/

PA-65 Schedu

ule H-Corp to

5300 BON

N 1

appo

rtion business

s income (loss

s) for

FEDERAL R

REPUBLIC OF

GERMANY

Com

mpleting

g

the c

orporate part

ner(s). The

O

R

partn

nership should

d use federal F

Form

DIETRICH

ENTERPRISES

S

PA Sc

chedule C

CP

1065

Schedule K-1

1 to calculate

117 RUSS

ELL DR

withh

holding for any

y corporate pa

artner

LONDON W

W1PGHQ

that d

did not file an

n RCT-101, PA

A

F

Foreign A

Address

s

ENGLAND

Corpo

orate Tax Rep

port. Corporat

e net

S

Standard

ds

incom

me tax withho

lding is based

d on

Canada (

(Only) Addre

ess Example

e

feder

ral Form 1065

5 Schedule K-1

1

I

f the PA S cor

rporation, part

tnership

The follow

wing address fo

ormat may be

e

incom

me only, witho

out regard to

losses

o

or entity forme

ed as a limited

d liability

used when

n the postal ad

ddress

or de

eductions. Eac

ch entity partn

ner

c

company that

is classified a

s a

delivery zo

one number is

s included in

shou

ld receive a co

opy of PA-20S

S/PA-

p

partnership or

PA S corpora

ation for

the addres

ss:

65 Sc

chedule H-Cor

rp.

fe

ederal income

e tax purposes

s is

lo

ocated outside

e the U.S., it i

is

NORTH BY

Y NORTHWEST

T CO

All PA-20S/

/PA-65 Sched

ules

im

mportant to w

write the foreig

gn

1010 CLEA

AR ST

CP must be

e filed with the

e PA-

a

address on the

e PA-20S/PA-6

65

OTTAWA O

ONT K1A OB1

65 Corp, D

irectory of

S

Schedule CP, a

according to U

U.S. Postal

CANADA

Corpo

orate Partners

s and provided

d to

S

Service standa

ards.

the c

orporate part

ners for filing

their

Failure to u

use these stan

ndards may

If the e

entity’s addre

ss does not fit

t

RCT-

101, PA Corpo

orate Tax Rep

port.

d

delay processi

ng of correspo

ondence

in the ava

ilable spaces

on the PA-

The c

corporate part

tners are not

n

necessary to c

complete the p

processing

20S/PA-65

5 Schedule CP

P using this

requi

red to submit

t the PA-20S/P

PA-65

o

of the return.

format, ple

ease include a

a separate

Sche

dule CP with t

their RCT-101

1, PA

To comply

with foreign a

address

statement

t with the form

m showing the

e

Corpo

orate Tax Rep

port.

s

standards, use

e the following

g rules

complete a

address.

A

nonfiling corp

porate partne

r is a

w

when completi

ing the addres

ss portion

corpo

oration as def

ined in § 7401

1 of

o

of the PA-20S/

/PA-65 Sched

ule CP.

the T

Tax Reform Co

ode of 1971, a

as

●

●

Eliminate ap

ostrophes, co

ommas,

PART

I

amen

nded, which h

as not filed an

n

p

periods and hy

yphens.

Genera

al Informa

ation for

RCT-

101, PA Corpo

orate Tax Rep

port,

●

●

Write the na

me of the ent

tity in the

and p

paid corporate

e net income t

tax

s

spaces provide

ed.

the Cor

rporate Pa

artner

for th

he previous ta

axable year.

●

●

Write the ad

dress in the s

space

Appo

ortionment rul

es apply.

p

provided, inclu

uding street an

nd

Name of

f Corporat

ion

b

building name

and number,

Enter the

name of the n

nonfiling

Cor

rporate P

Partners

s

a

apartment or s

suite numbers

s, city

corporatio

n partner (C c

corporation).

n

name and city

or provincial

codes.

The a

amount on Lin

ne 16 of PA-

●

●

Write only th

he name of th

e country

20S/

PA-65 Schedu

ule CP is remit

tted

Corpora

ate Partner

r FEIN

in

n the space pr

rovided for th

e city or

by th

he issuing part

tnership on th

he

Enter the

nine-digit fede

eral employer

r

p

post office.

corpo

oration’s beha

alf for paymen

nt of

identificati

ion number (F

FEIN) of the

corpo

orate net inco

me tax

corporate

partner (C co

orporation).

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3