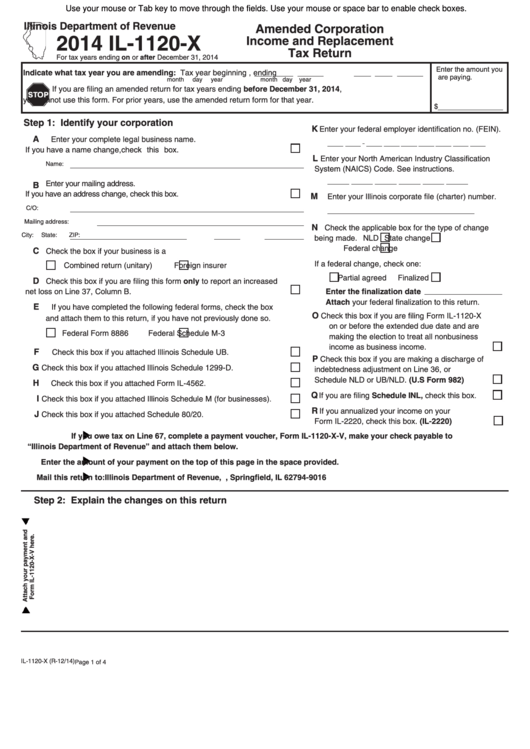

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Amended Corporation

2014 IL-1120-X

Income and Replacement

Tax Return

For tax years ending on or after December 31, 2014

Enter the amount you

Indicate what tax year you are amending: Tax year beginning

, ending

are paying.

month

day

year

month

day

year

If you are filing an amended return for tax years ending before December 31, 2014,

you cannot use this form. For prior years, use the amended return form for that year.

$

Step 1: Identify your corporation

K

Enter your federal employer identification no. (FEIN).

A

Enter your complete legal business name.

If you have a name change, check this box.

L

Enter your North American Industry Classification

Name:

System (NAICS) Code. See instructions.

Enter your mailing address.

B

M

If you have an address change, check this box.

Enter your Illinois corporate file (charter) number.

C/O:

Mailing address:

N

Check the applicable box for the type of change

City:

State:

ZIP:

being made.

NLD

State change

Federal change

C

Check the box if your business is a

If a federal change, check one:

Combined return (unitary)

Foreign insurer

Partial agreed

Finalized

D

Check this box if you are filing this form only to report an increased

net loss on Line 37, Column B.

Enter the finalization date

Attach your federal finalization to this return.

E

If you have completed the following federal forms, check the box

O

Check this box if you are filing Form IL-1120-X

and attach them to this return, if you have not previously done so.

on or before the extended due date and are

Federal Form 8886

Federal Schedule M-3

making the election to treat all nonbusiness

income as business income.

F

Check this box if you attached Illinois Schedule UB.

P

Check this box if you are making a discharge of

G

Check this box if you attached Illinois Schedule 1299-D.

indebtedness adjustment on Line 36, or

Schedule NLD or UB/NLD. (U.S Form 982)

H

Check this box if you attached Form IL-4562.

Q

If you are filing Schedule INL, check this box.

I

Check this box if you attached Illinois Schedule M (for businesses).

R

If you annualized your income on your

J

Check this box if you attached Schedule 80/20.

Form IL-2220, check this box. (IL-2220)

If you owe tax on Line 67, complete a payment voucher, Form IL-1120-X-V, make your check payable to

“Illinois Department of Revenue” and attach them below.

Enter the amount of your payment on the top of this page in the space provided.

Mail this return to: Illinois Department of Revenue, P.O. Box 19016, Springfield, IL 62794-9016

Step 2: Explain the changes on this return

IL-1120-X (R-12/14)

Page 1 of 4

1

1 2

2 3

3 4

4