Form Ct-222 - Underpayment Of Estimated Tax By A Corporation - 2013

ADVERTISEMENT

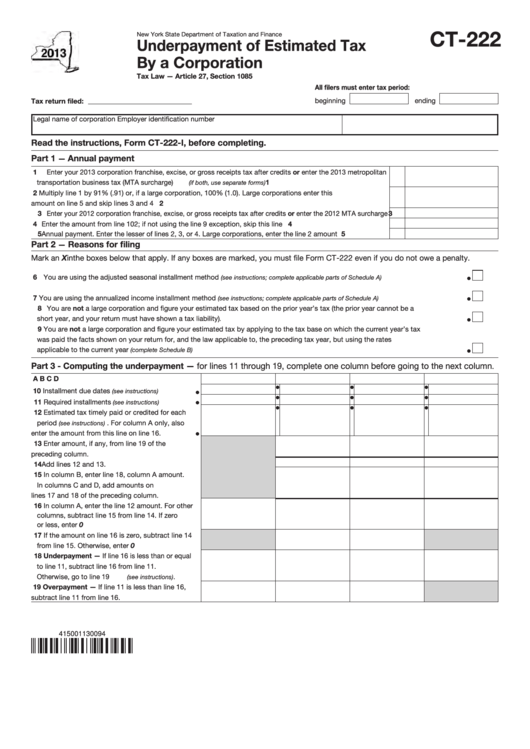

CT-222

New York State Department of Taxation and Finance

Underpayment of Estimated Tax

By a Corporation

Tax Law — Article 27, Section 1085

All filers must enter tax period:

beginning

ending

Tax return filed:

Legal name of corporation

Employer identification number

Read the instructions, Form CT-222-I, before completing.

Part 1

Annual payment

—

1 Enter your 2013 corporation franchise, excise, or gross receipts tax after credits or enter the 2013 metropolitan

transportation business tax (MTA surcharge)

..............................................................

1

(if both, use separate forms)

2 Multiply line 1 by 91% (.91) or, if a large corporation, 100% (1.0). Large corporations enter this

amount on line 5 and skip lines 3 and 4 .............................................................................................................

2

3 Enter your 2012 corporation franchise, excise, or gross receipts tax after credits or enter the 2012 MTA surcharge

3

4 Enter the amount from line 102; if not using the line 9 exception, skip this line ...................................................

4

5 Annual payment. Enter the lesser of lines 2, 3, or 4. Large corporations, enter the line 2 amount .......................

5

Part 2

Reasons for filing

—

Mark an X in the boxes below that apply. If any boxes are marked, you must file Form CT-222 even if you do not owe a penalty.

6 You are using the adjusted seasonal installment method

............................................

(see instructions; complete applicable parts of Schedule A)

7 You are using the annualized income installment method

............................................

(see instructions; complete applicable parts of Schedule A)

8 You are not a large corporation and figure your estimated tax based on the prior year’s tax (the prior year cannot be a

short year, and your return must have shown a tax liability)

.........................................................................................................................

.

9 You are not a large corporation and figure your estimated tax by applying to the tax base on which the current year’s tax

was paid the facts shown on your return for, and the law applicable to, the preceding tax year, but using the rates

applicable to the current year

(complete Schedule B)

.......................................................................................................................................

Part 3 - Computing the underpayment — for lines 11 through 19, complete one column before going to the next column

.

A

B

C

D

10 Installment due dates

.................

(see instructions)

11 Required installments

.................

(see instructions)

12 Estimated tax timely paid or credited for each

period

. For column A only, also

(see instructions)

enter the amount from this line on line 16. ......

13 Enter amount, if any, from line 19 of the

preceding column. .............................................

14 Add lines 12 and 13. ............................................

15 In column B, enter line 18, column A amount.

In columns C and D, add amounts on

lines 17 and 18 of the preceding column. ........

16 In column A, enter the line 12 amount. For other

columns, subtract line 15 from line 14. If zero

or less, enter 0 ..................................................

17 If the amount on line 16 is zero, subtract line 14

from line 15. Otherwise, enter 0 ........................

18 Underpayment — If line 16 is less than or equal

to line 11, subtract line 16 from line 11.

Otherwise, go to line 19

. ...........

(see instructions)

19 Overpayment — If line 11 is less than line 16,

subtract line 11 from line 16. ............................

415001130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4