Form Dr-841 - Request For Copy Of Tax Return - 2013

ADVERTISEMENT

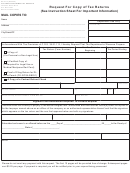

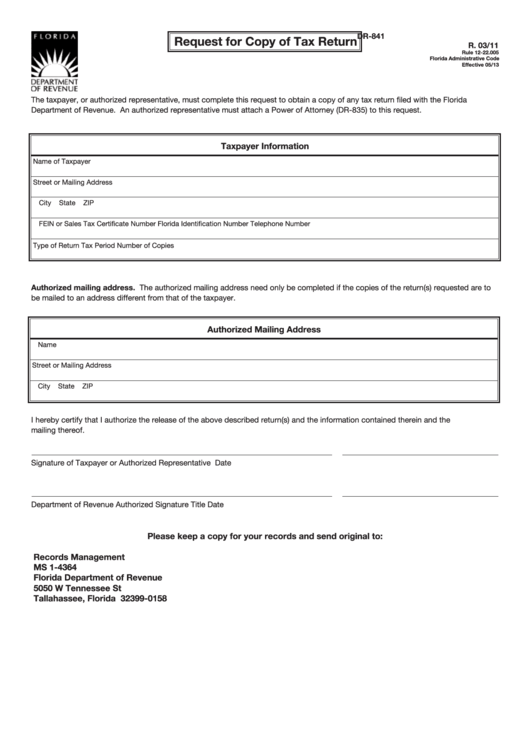

DR-841

Request for Copy of Tax Return

R. 03/11

Rule 12-22.005

Florida Administrative Code

Effective 05/13

The taxpayer, or authorized representative, must complete this request to obtain a copy of any tax return filed with the Florida

Department of Revenue. An authorized representative must attach a Power of Attorney (DR-835) to this request.

Taxpayer Information

Name of Taxpayer

Street or Mailing Address

City

State

ZIP

FEIN or Sales Tax Certificate Number

Florida Identification Number

Telephone Number

Type of Return

Tax Period

Number of Copies

Authorized mailing address. The authorized mailing address need only be completed if the copies of the return(s) requested are to

be mailed to an address different from that of the taxpayer.

Authorized Mailing Address

Name

Street or Mailing Address

City

State

ZIP

I hereby certify that I authorize the release of the above described return(s) and the information contained therein and the

mailing thereof.

Signature of Taxpayer or Authorized Representative

Date

Department of Revenue Authorized Signature

Title

Date

Please keep a copy for your records and send original to:

Records Management

MS 1-4364

Florida Department of Revenue

5050 W Tennessee St

Tallahassee, Florida 32399-0158

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1