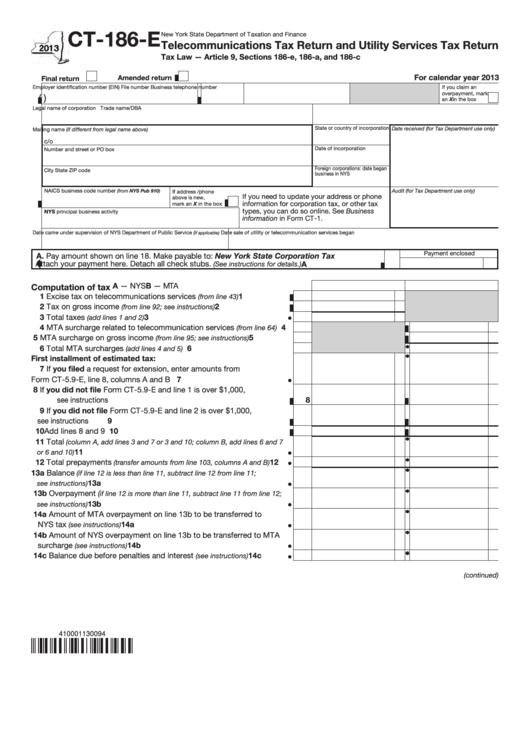

CT-186-E

New York State Department of Taxation and Finance

Telecommunications Tax Return and Utility Services Tax Return

Tax Law — Article 9, Sections 186-e, 186-a, and 186-c

For calendar year 2013

Amended return

Final return

Employer identification number (EIN)

File number

Business telephone number

If you claim an

overpayment, mark

(

)

an X in the box

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above)

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

NAICS business code number

Audit (for Tax Department use only)

(from NYS Pub 910)

If address /phone

If you need to update your address or phone

above is new,

information for corporation tax, or other tax

mark an X in the box

types, you can do so online. See Business

NYS principal business activity

information in Form CT-1.

Date came under supervision of NYS Department of Public Service (

Date sale of utility or telecommunication services began

if applicable)

Payment enclosed

A. Pay amount shown on line 18. Make payable to: New York State Corporation Tax

Attach your payment here. Detach all check stubs.

A

(See instructions for details.)

A — NYS

B — MTA

Computation of tax

1 Excise tax on telecommunications services

....................

1

(from line 43)

2 Tax on gross income

................................

2

(from line 92; see instructions)

3 Total taxes

................................................................

3

(add lines 1 and 2)

4 MTA surcharge related to telecommunication services

4

....

(from line 64)

5 MTA surcharge on gross income

..............

5

(from line 95; see instructions)

6 Total MTA surcharges

................................................

6

(add lines 4 and 5)

First installment of estimated tax:

7 If you filed a request for extension, enter amounts from

Form CT-5.9-E, line 8, columns A and B .........................................

7

8 If you did not file Form CT-5.9-E and line 1 is over $1,000,

see instructions ........................................................................................

8

9 If you did not file Form CT-5.9-E and line 2 is over $1,000,

9

see instructions ..................................................................................

10 Add lines 8 and 9 .................................................................................

10

11 Total

(column A, add lines 3 and 7 or 3 and 10; column B, add lines 6 and 7

........................................................................................

11

or 6 and 10)

12 Total prepayments

12

.......

(transfer amounts from line 103, columns A and B)

13a Balance

(if line 12 is less than line 11, subtract line 12 from line 11;

..................................................................................

13a

see instructions)

13b Overpayment (

if line 12 is more than line 11, subtract line 11 from line 12;

...................................................................................

13b

see instructions)

14a Amount of MTA overpayment on line 13b to be transferred to

14a

NYS tax

...................................................................

(see instructions)

14b Amount of NYS overpayment on line 13b to be transferred to MTA

surcharge

.................................................................

14b

(see instructions)

14c Balance due before penalties and interest

.................

14c

(see instructions)

(continued)

410001130094

1

1 2

2 3

3 4

4 5

5 6

6