Form Ct-223 - Innovation Hot Spot Deduction - 2013

ADVERTISEMENT

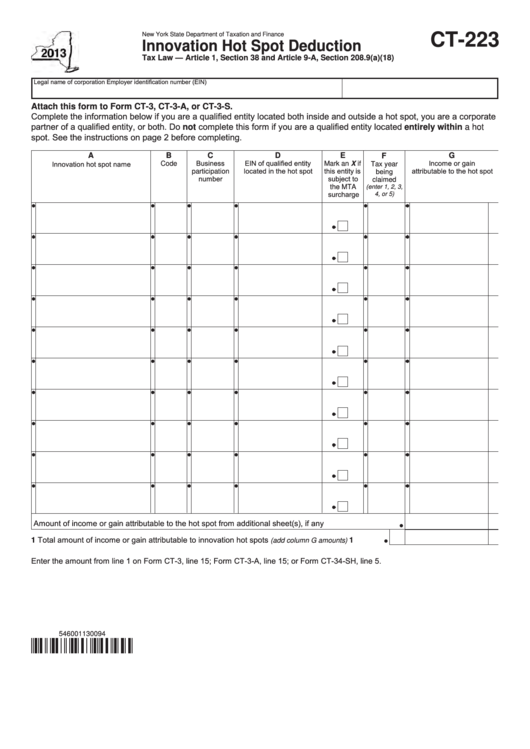

New York State Department of Taxation and Finance

CT-223

Innovation Hot Spot Deduction

Tax Law — Article 1, Section 38 and Article 9-A, Section 208.9(a)(18)

Legal name of corporation

Employer identification number (EIN)

Attach this form to Form CT-3, CT-3-A, or CT-3-S.

Complete the information below if you are a qualified entity located both inside and outside a hot spot, you are a corporate

partner of a qualified entity, or both. Do not complete this form if you are a qualified entity located entirely within a hot

spot. See the instructions on page 2 before completing.

A

B

C

D

E

G

F

Business

EIN of qualified entity

Income or gain

Innovation hot spot name

Code

Mark an X if

Tax year

located in the hot spot

this entity is

attributable to the hot spot

being

participation

number

subject to

claimed

the MTA

(enter 1, 2, 3,

surcharge

4, or 5)

Amount of income or gain attributable to the hot spot from additional sheet(s), if any ..................................

1 Total amount of income or gain attributable to innovation hot spots

................

1

(add column G amounts)

Enter the amount from line 1 on Form CT-3, line 15; Form CT-3-A, line 15; or Form CT-34-SH, line 5.

546001130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2