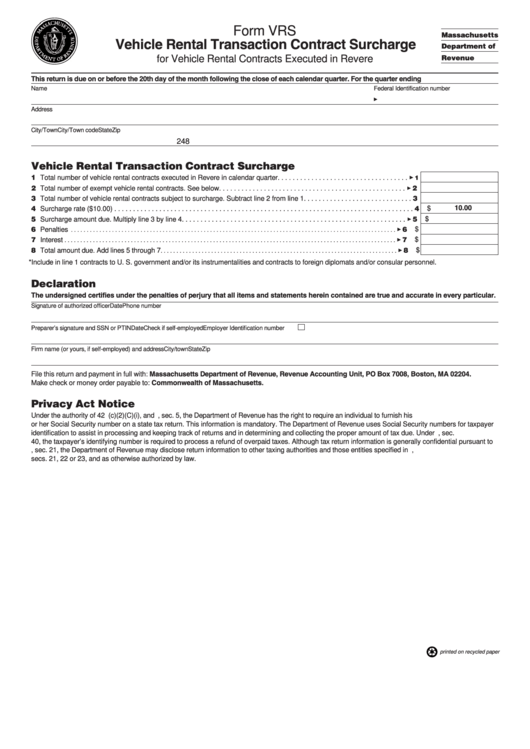

Rev. 8/00

Form VRS

Massachusetts

Vehicle Rental Transaction Contract Surcharge

Department of

for Vehicle Rental Contracts Executed in Revere

Revenue

This return is due on or before the 20th day of the month following the close of each calendar quarter. For the quarter ending

Name

Federal Identification number

3

Address

City/Town

City/Town code

State

Zip

248

Vehicle Rental Transaction Contract Surcharge

1 Total number of vehicle rental contracts executed in Revere in calendar quarter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

1

2 Total number of exempt vehicle rental contracts. See below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

3 Total number of vehicle rental contracts subject to surcharge. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

10.00

4 Surcharge rate ($10.00) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

$

5 Surcharge amount due. Multiply line 3 by line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

$

$

6 Penalties

3 6

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

7 Interest

3 7

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

8 Total amount due. Add lines 5 through 7

3 8

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

*Include in line 1 contracts to U. S. government and/or its instrumentalities and contracts to foreign diplomats and/or consular personnel.

Declaration

The undersigned certifies under the penalties of perjury that all items and statements herein contained are true and accurate in every particular.

Signature of authorized officer

Date

Phone number

Preparer’s signature and SSN or PTIN

Date

Check if self-employed

Employer Identification number

Firm name (or yours, if self-employed) and address

City/town

State

Zip

File this return and payment in full with: Massachusetts Department of Revenue, Revenue Accounting Unit, PO Box 7008, Boston, MA 02204.

Make check or money order payable to: Commonwealth of Massachusetts.

Privacy Act Notice

Under the authority of 42 U.S.C. sec. 405(c)(2)(C)(i), and M.G.L. c. 62C, sec. 5, the Department of Revenue has the right to require an individual to furnish his

or her Social Security number on a state tax return. This information is mandatory. The Department of Revenue uses Social Security numbers for taxpayer

identification to assist in processing and keeping track of returns and in determining and collecting the proper amount of tax due. Under M.G.L. c. 62C, sec.

40, the taxpayer’s identifying number is required to process a refund of overpaid taxes. Although tax return information is generally confidential pursuant to

M.G.L. c. 62C, sec. 21, the Department of Revenue may disclose return information to other taxing authorities and those entities specified in M.G.L. c. 62C,

secs. 21, 22 or 23, and as otherwise authorized by law.

printed on recycled paper

1

1