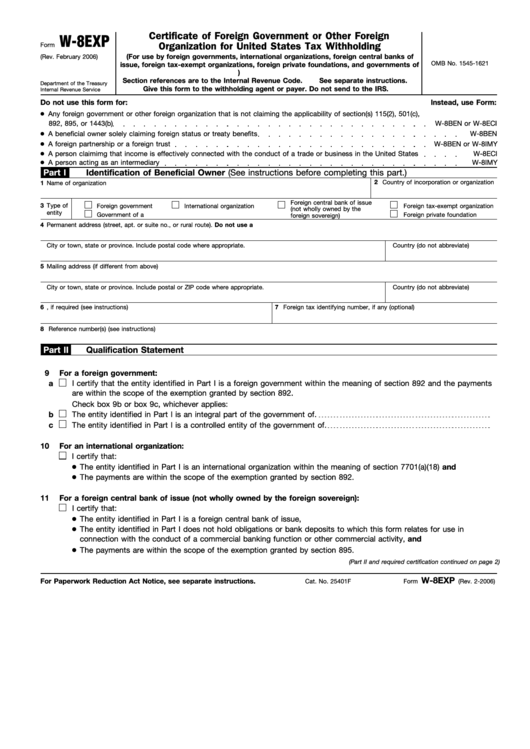

Certificate of Foreign Government or Other Foreign

W-8EXP

Form

Organization for United States Tax Withholding

(For use by foreign governments, international organizations, foreign central banks of

(Rev. February 2006)

OMB No. 1545-1621

issue, foreign tax-exempt organizations, foreign private foundations, and governments of

U.S. possessions.)

Section references are to the Internal Revenue Code.

See separate instructions.

Department of the Treasury

Give this form to the withholding agent or payer. Do not send to the IRS.

Internal Revenue Service

Do not use this form for:

Instead, use Form:

Any foreign government or other foreign organization that is not claiming the applicability of section(s) 115(2), 501(c),

892, 895, or 1443(b)

W-8BEN or W-8ECI

A beneficial owner solely claiming foreign status or treaty benefits

W-8BEN

A foreign partnership or a foreign trust

W-8BEN or W-8IMY

A person claimimg that income is effectively connected with the conduct of a trade or business in the United States

W-8ECI

A person acting as an intermediary

W-8IMY

Part I

Identification of Beneficial Owner (See instructions before completing this part.)

2 Country of incorporation or organization

1

Name of organization

Foreign central bank of issue

3

Type of

Foreign government

International organization

Foreign tax-exempt organization

(not wholly owned by the

entity

Government of a U.S. possession

Foreign private foundation

foreign sovereign)

4

Permanent address (street, apt. or suite no., or rural route). Do not use a P.O. box.

City or town, state or province. Include postal code where appropriate.

Country (do not abbreviate)

5

Mailing address (if different from above)

City or town, state or province. Include postal or ZIP code where appropriate.

Country (do not abbreviate)

6

U.S. taxpayer identification number, if required (see instructions)

7

Foreign tax identifying number, if any (optional)

8

Reference number(s) (see instructions)

Part II

Qualification Statement

9

For a foreign government:

a

I certify that the entity identified in Part I is a foreign government within the meaning of section 892 and the payments

are within the scope of the exemption granted by section 892.

Check box 9b or box 9c, whichever applies:

b

The entity identified in Part I is an integral part of the government of

.

c

The entity identified in Part I is a controlled entity of the government of

.

10

For an international organization:

I certify that:

The entity identified in Part I is an international organization within the meaning of section 7701(a)(18) and

The payments are within the scope of the exemption granted by section 892.

11

For a foreign central bank of issue (not wholly owned by the foreign sovereign):

I certify that:

The entity identified in Part I is a foreign central bank of issue,

The entity identified in Part I does not hold obligations or bank deposits to which this form relates for use in

connection with the conduct of a commercial banking function or other commercial activity, and

The payments are within the scope of the exemption granted by section 895.

(Part II and required certification continued on page 2)

W-8EXP

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 25401F

Form

(Rev. 2-2006)

1

1 2

2