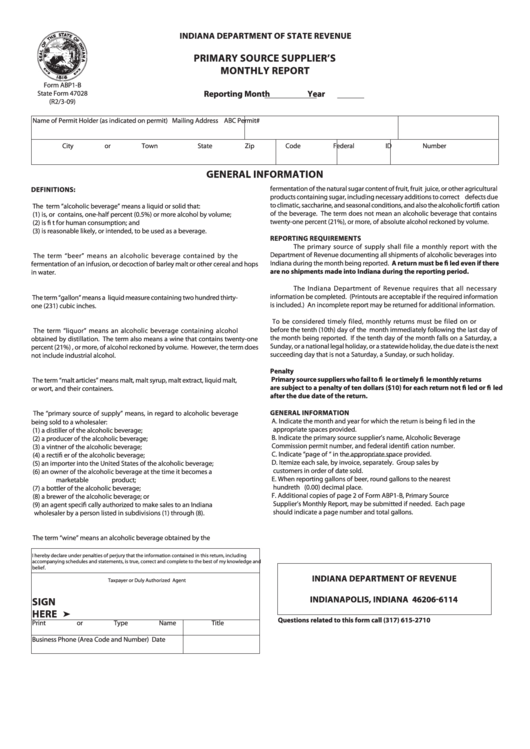

INDIANA DEPARTMENT OF STATE REVENUE

PRIMARY SOURCE SUPPLIER’S

MONTHLY REPORT

Form ABP1-B

State Form 47028

Reporting Month

Year

(R2/3-09)

Name of Permit Holder (as indicated on permit)

Mailing Address

ABC Permit#

City or Town

State

Zip Code

Federal ID Number

GENERAL INFORMATION

fermentation of the natural sugar content of fruit, fruit juice, or other agricultural

DEFINITIONS:

products containing sugar, including necessary additions to correct defects due

I.C. 7.1-1-3-5 Alcoholic Beverage

to climatic, saccharine, and seasonal conditions, and also the alcoholic fortifi cation

The term “alcoholic beverage” means a liquid or solid that:

of the beverage. The term does not mean an alcoholic beverage that contains

(1) is, or contains, one-half percent (0.5%) or more alcohol by volume;

twenty-one percent (21%), or more, of absolute alcohol reckoned by volume.

(2) is fi t for human consumption; and

(3) is reasonable likely, or intended, to be used as a beverage.

REPORTING REQUIREMENTS

The primary source of supply shall file a monthly report with the

I.C. 7.1-1-3-6 Beer

Department of Revenue documenting all shipments of alcoholic beverages into

The term “beer” means an alcoholic beverage contained by the

Indiana during the month being reported. A return must be fi led even if there

fermentation of an infusion, or decoction of barley malt or other cereal and hops

are no shipments made into Indiana during the reporting period.

in water.

The Indiana Department of Revenue requires that all necessary

I.C. 7.1-1-3-18 Gallon

information be completed. (Printouts are acceptable if the required information

The term “gallon” means a liquid measure containing two hundred thirty-

is included.) An incomplete report may be returned for additional information.

one (231) cubic inches.

To be considered timely filed, monthly returns must be filed on or

I.C. 7.1-1-3-21 Liquor

before the tenth (10th) day of the month immediately following the last day of

The term “liquor” means an alcoholic beverage containing alcohol

the month being reported. If the tenth day of the month falls on a Saturday, a

obtained by distillation. The term also means a wine that contains twenty-one

Sunday, or a national legal holiday, or a statewide holiday, the due date is the next

percent (21%) , or more, of alcohol reckoned by volume. However, the term does

succeeding day that is not a Saturday, a Sunday, or such holiday.

not include industrial alcohol.

Penalty

I.C. 7.1-1-3-23 Malt Articles

Primary source suppliers who fail to fi le or timely fi le monthly returns

The term “malt articles” means malt, malt syrup, malt extract, liquid malt,

are subject to a penalty of ten dollars ($10) for each return not fi led or fi led

or wort, and their containers.

after the due date of the return.

I.C. 7.1-3-32.5 Primary Source of Supply

GENERAL INFORMATION

The “primary source of supply” means, in regard to alcoholic beverage

A. Indicate the month and year for which the return is being fi led in the

being sold to a wholesaler:

appropriate spaces provided.

(1) a distiller of the alcoholic beverage;

B. Indicate the primary source supplier’s name, Alcoholic Beverage

(2) a producer of the alcoholic beverage;

Commission permit number, and federal identifi cation number.

(3) a vintner of the alcoholic beverage;

C. Indicate “page

of

“ in the appropriate space provided.

(4) a rectifi er of the alcoholic beverage;

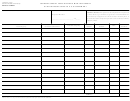

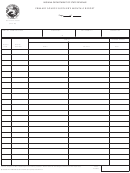

D. Itemize each sale, by invoice, separately. Group sales by

(5) an importer into the United States of the alcoholic beverage;

customers in order of date sold.

(6) an owner of the alcoholic beverage at the time it becomes a

E. When reporting gallons of beer, round gallons to the nearest

marketable product;

hundreth (0.00) decimal place.

(7) a bottler of the alcoholic beverage;

F. Additional copies of page 2 of Form ABP1-B, Primary Source

(8) a brewer of the alcoholic beverage; or

Supplier’s Monthly Report, may be submitted if needed. Each page

(9) an agent specifi cally authorized to make sales to an Indiana

should indicate a page number and total gallons.

wholesaler by a person listed in subdivisions (1) through (8).

I.C. 7.1-1-3-46 Table Wine

The term “wine” means an alcoholic beverage obtained by the

I hereby declare under penalties of perjury that the information contained in this return, including

accompanying schedules and statements, is true, correct and complete to the best of my knowledge and

belief.

INDIANA DEPARTMENT OF REVENUE

Taxpayer or Duly Authorized Agent

P.O. BOX 6114

INDIANAPOLIS, INDIANA 46206-6114

SIGN

HERE

Questions related to this form call (317) 615-2710

Print or Type Name

Title

Business Phone (Area Code and Number) Date

1

1 2

2