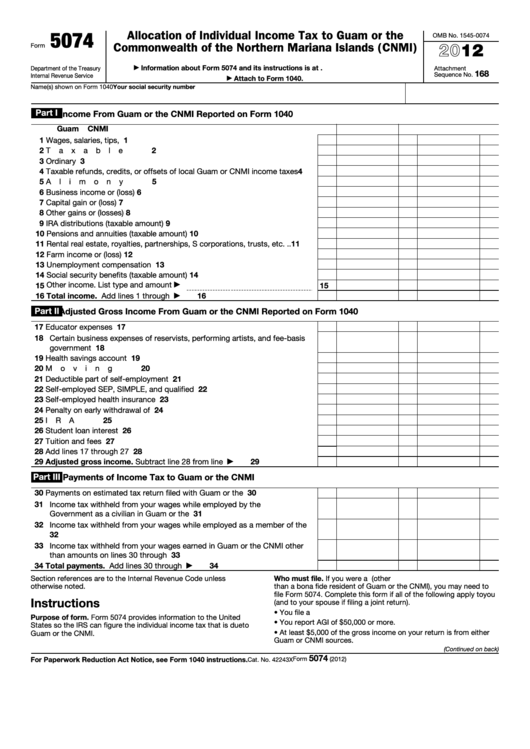

5074

Allocation of Individual Income Tax to Guam or the

OMB No. 1545-0074

2012

Commonwealth of the Northern Mariana Islands (CNMI)

Form

Information about Form 5074 and its instructions is at

Department of the Treasury

Attachment

▶

168

Sequence No.

Internal Revenue Service

Attach to Form 1040.

▶

Your social security number

Name(s) shown on Form 1040

Part I

Income From Guam or the CNMI Reported on Form 1040

Guam

CNMI

1 Wages, salaries, tips, etc. .

1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2 Taxable interest

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3 Ordinary dividends

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4 Taxable refunds, credits, or offsets of local Guam or CNMI income taxes

4

5 Alimony received .

5

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6 Business income or (loss) .

6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7 Capital gain or (loss) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8 Other gains or (losses) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9 IRA distributions (taxable amount)

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10 Pensions and annuities (taxable amount) .

.

.

.

.

.

.

.

.

.

.

10

11 Rental real estate, royalties, partnerships, S corporations, trusts, etc. .

11

.

12 Farm income or (loss)

12

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13 Unemployment compensation

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

14 Social security benefits (taxable amount) .

.

.

.

.

.

.

.

.

.

.

14

15 Other income. List type and amount

15

▶

16 Total income. Add lines 1 through 15 .

16

.

.

.

.

.

.

.

.

.

.

▶

Part II

Adjusted Gross Income From Guam or the CNMI Reported on Form 1040

17 Educator expenses .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

18 Certain business expenses of reservists, performing artists, and fee-basis

government officials .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18

19 Health savings account deduction

19

.

.

.

.

.

.

.

.

.

.

.

.

.

20 Moving expenses .

20

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

21 Deductible part of self-employment tax .

.

.

.

.

.

.

.

.

.

.

.

21

22 Self-employed SEP, SIMPLE, and qualified plans

.

.

.

.

.

.

.

.

22

23 Self-employed health insurance deduction.

.

.

.

.

.

.

.

.

.

.

23

24 Penalty on early withdrawal of savings .

24

.

.

.

.

.

.

.

.

.

.

.

25 IRA deduction .

25

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

26 Student loan interest deduction .

.

.

.

.

.

.

.

.

.

.

.

.

.

26

27 Tuition and fees

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

27

28 Add lines 17 through 27 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

28

29 Adjusted gross income. Subtract line 28 from line 16 .

.

.

.

.

.

29

▶

Part III

Payments of Income Tax to Guam or the CNMI

30 Payments on estimated tax return filed with Guam or the CNMI .

.

.

.

30

31 Income tax withheld from your wages while employed by the U.S.

Government as a civilian in Guam or the CNMI .

.

.

.

.

.

.

.

.

31

32 Income tax withheld from your wages while employed as a member of the

32

U.S. Armed Forces in Guam or the CNMI .

.

.

.

.

.

.

.

.

.

.

33 Income tax withheld from your wages earned in Guam or the CNMI other

than amounts on lines 30 through 32

.

.

.

.

.

.

.

.

.

.

.

.

33

34 Total payments. Add lines 30 through 33.

.

.

.

.

.

.

.

.

.

34

▶

Section references are to the Internal Revenue Code unless

Who must file. If you were a U.S. citizen or resident alien (other

otherwise noted.

than a bona fide resident of Guam or the CNMI), you may need to

file Form 5074. Complete this form if all of the following apply to you

Instructions

(and to your spouse if filing a joint return).

• You file a U.S. income tax return.

Purpose of form. Form 5074 provides information to the United

• You report AGI of $50,000 or more.

States so the IRS can figure the individual income tax that is due to

• At least $5,000 of the gross income on your return is from either

Guam or the CNMI.

Guam or CNMI sources.

(Continued on back)

5074

For Paperwork Reduction Act Notice, see Form 1040 instructions.

Form

(2012)

Cat. No. 42243X

1

1 2

2