Form Dr-309640 - Application For Refund Of Tax Paid On Undyed Diesel Consumed By Motor Coaches During Idle Time In Florida - 2014

ADVERTISEMENT

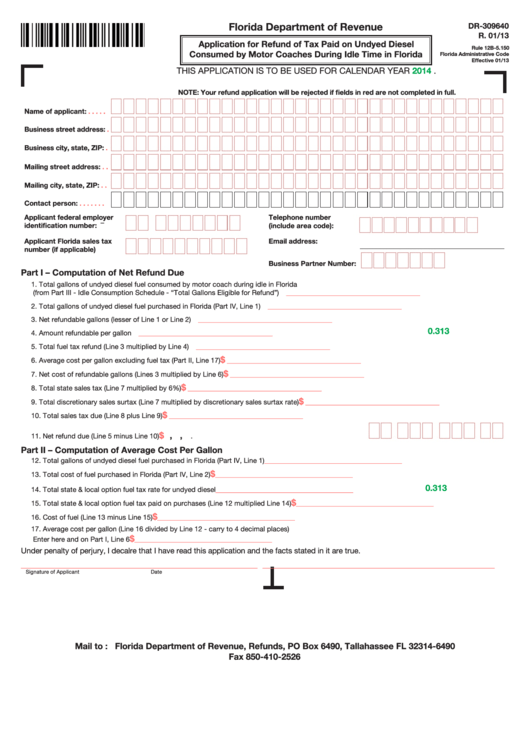

Florida Department of Revenue

DR-309640

R. 01/13

Application for Refund of Tax Paid on Undyed Diesel

Rule 12B-5.150

Consumed by Motor Coaches During Idle Time in Florida

Florida Administrative Code

Effective 01/13

2014

THIS APPLICATION IS TO BE USED FOR CALENDAR YEAR

.

NOTE: Your refund application will be rejected if fields in red are not completed in full.

Name of applicant:

. . . . .

Business street address:

.

Business city, state, ZIP:

.

Mailing street address:

. .

Mailing city, state, ZIP:

. .

Contact person:

. . . . . . .

Applicant federal employer

Telephone number

–

identification number:

(include area code):

Applicant Florida sales tax

Email address:

number (if applicable)

Business Partner Number:

Part I – Computation of Net Refund Due

1.

Total gallons of undyed diesel fuel consumed by motor coach during idle in Florida

(from Part III - Idle Consumption Schedule - “Total Gallons Eligible for Refund”) ......................................

______________________________________

2.

Total gallons of undyed diesel fuel purchased in Florida (Part IV, Line 1) ...................................................

______________________________________

3.

Net refundable gallons (lesser of Line 1 or Line 2) ......................................................................................

______________________________________

0.313

4.

Amount refundable per gallon ....................................................................................................................

______________________________________

5.

Total fuel tax refund (Line 3 multiplied by Line 4) ........................................................................................

______________________________________

$

6.

Average cost per gallon excluding fuel tax (Part II, Line 17) .....................................................................

______________________________________

$

7.

Net cost of refundable gallons (Lines 3 multiplied by Line 6) ...................................................................

______________________________________

$

8.

Total state sales tax (Line 7 multiplied by 6%) ..........................................................................................

______________________________________

$

9.

Total discretionary sales surtax (Line 7 multiplied by discretionary sales surtax rate) .............................

______________________________________

$

10. Total sales tax due (Line 8 plus Line 9) .....................................................................................................

______________________________________

$

,

,

11. Net refund due (Line 5 minus Line 10) ......................................................................................................

.

Part II – Computation of Average Cost Per Gallon

12. Total gallons of undyed diesel fuel purchased in Florida (Part IV, Line 1) .................................................

_______________________________________

$

13. Total cost of fuel purchased in Florida (Part IV, Line 2) .............................................................................

_______________________________________

0.313

14. Total state & local option fuel tax rate for undyed diesel ..........................................................................

_______________________________________

$

15. Total state & local option fuel tax paid on purchases (Line 12 multiplied Line 14) ...................................

_______________________________________

$

16. Cost of fuel (Line 13 minus Line 15) ..........................................................................................................

_______________________________________

17. Average cost per gallon (Line 16 divided by Line 12 - carry to 4 decimal places)

$

Enter here and on Part I, Line 6 ................................................................................................................

_______________________________________

Under penalty of perjury, I decalre that I have read this application and the facts stated in it are true.

______________________________________________________

_____________________________________________________

Signature of Applicant

Date

Mail to : Florida Department of Revenue, Refunds, PO Box 6490, Tallahassee FL 32314-6490

Fax 850-410-2526

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5