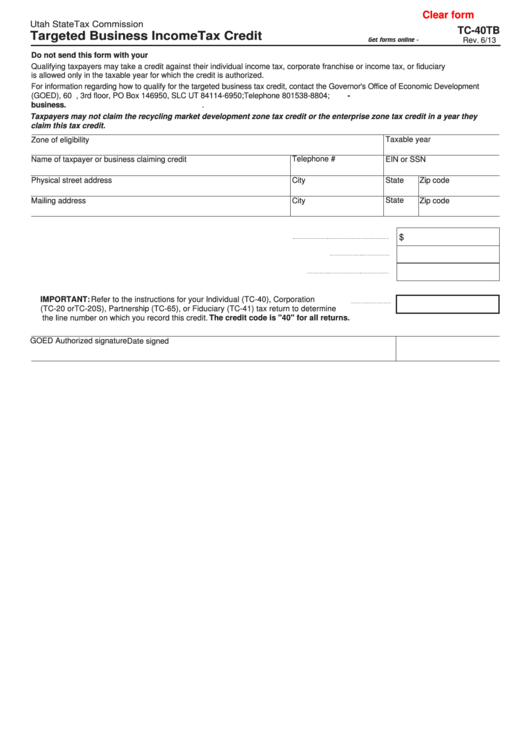

Clear form

Utah State Tax Commission

TC-40TB

Targeted Business Income Tax Credit

Get forms online - tax.utah.gov

Rev. 6/13

Do not send this form with your return. Keep this form and all related documents with your records.

Qualifying taxpayers may take a credit against their individual income tax, corporate franchise or income tax, or fiduciary tax. The credit

is allowed only in the taxable year for which the credit is authorized.

For information regarding how to qualify for the targeted business tax credit, contact the Governor's Office of Economic Development

(GOED), 60 E. South Temple, 3rd floor, PO Box 146950, SLC UT 84114-6950; Telephone 801 538-8804;

-

business.

utah.gov/incentives/enterprise_zones

.

Taxpayers may not claim the recycling market development zone tax credit or the enterprise zone tax credit in a year they

claim this tax credit.

Zone of eligibility

Taxable year

Telephone #

Name of taxpayer or business claiming credit

EIN or SSN

Physical street address

City

State

Zip code

City

State

Zip code

Mailing address

$

1. Maximum credit the business applicant is eligible for in this taxable year

2. Reductions in the maximum credit because of failure to comply with requirements

3. Allocated cap amount the business applicant may claim for this taxable year

4. Credit amount the business applicant may claim for this taxable year

IMPORTANT:

Refer to the instructions for your Individual (TC-40), Corporation

(TC-20 or TC-20S), Partnership (TC-65), or Fiduciary (TC-41) tax return to determine

the line number on which you record this credit.

The credit code is "40" for all returns.

GOED Authorized signature

Date signed

1

1