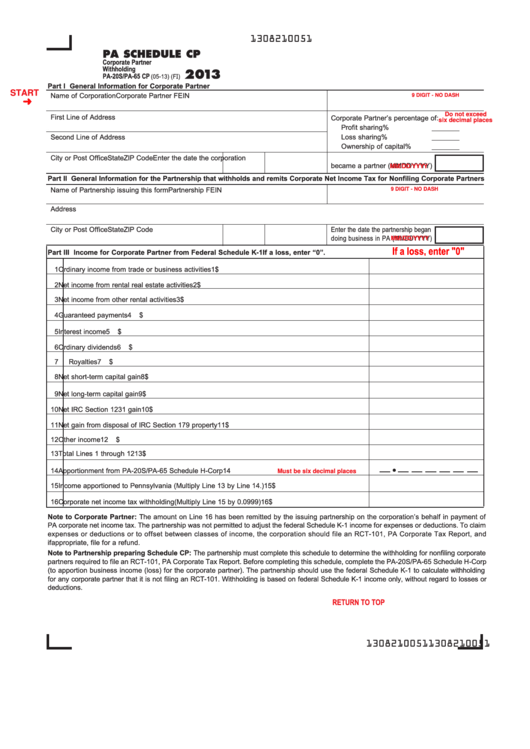

1308210051

PA SCHEDULE CP

Corporate Partner

Withholding

2013

PA-20S/PA-65 CP

(05-13) (FI)

Part I General Information for Corporate Partner

START

Name of Corporation

Corporate Partner FEIN

9 DIGIT - NO DASH

Do not exceed

First Line of Address

Corporate Partner’s percentage of:

six decimal places

Profit sharing

%

Second Line of Address

Loss sharing

%

Ownership of capital

%

City or Post Office

State

ZIP Code

Enter the date the corporation

became a partner (MMDDYYYY)

MM/DD/YYYY

Part II General Information for the Partnership that withholds and remits Corporate Net Income Tax for Nonfiling Corporate Partners

Name of Partnership issuing this form

Partnership FEIN

9 DIGIT - NO DASH

Address

City or Post Office

State

ZIP Code

Enter the date the partnership began

doing business in PA (MMDDYYYY)

MM/DD/YYYY

If a loss, enter "0"

Part III Income for Corporate Partner from Federal Schedule K-1

If a loss, enter “0”.

1

Ordinary income from trade or business activities

1

$

2

Net income from rental real estate activities

2

$

3

Net income from other rental activities

3

$

4

Guaranteed payments

4

$

5

Interest income

5

$

6

Ordinary dividends

6

$

7

Royalties

7

$

8

Net short-term capital gain

8

$

9

Net long-term capital gain

9

$

10

Net IRC Section 1231 gain

10

$

11

Net gain from disposal of IRC Section 179 property

11

$

12

Other income

12

$

13

Total Lines 1 through 12

13

$

l

14

Apportionment from PA-20S/PA-65 Schedule H-Corp

Must be six decimal places

14

15

Income apportioned to Pennsylvania (Multiply Line 13 by Line 14.)

15

$

16

Corporate net income tax withholding (Multiply Line 15 by 0.0999)

16

$

Note to Corporate Partner: The amount on Line 16 has been remitted by the issuing partnership on the corporation’s behalf in payment of

PA corporate net income tax. The partnership was not permitted to adjust the federal Schedule K-1 income for expenses or deductions. To claim

expenses or deductions or to offset between classes of income, the corporation should file an RCT-101, PA Corporate Tax Report, and

if appropriate, file for a refund.

Note to Partnership preparing Schedule CP: The partnership must complete this schedule to determine the withholding for nonfiling corporate

partners required to file an RCT-101, PA Corporate Tax Report. Before completing this schedule, complete the PA-20S/PA-65 Schedule H-Corp

(to apportion business income (loss) for the corporate partner). The partnership should use the federal Schedule K-1 to calculate withholding

for any corporate partner that it is not filing an RCT-101. Withholding is based on federal Schedule K-1 income only, without regard to losses or

deductions.

RETURN TO TOP

PRINT FORM

Reset Form

1308210051

1308210051

1

1