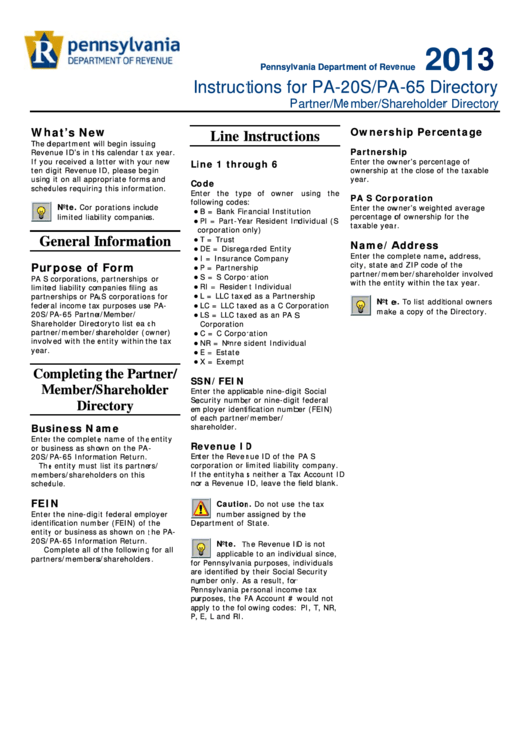

Instructions For Form Pa-20s/pa-65 - Directory - Partner/member/shareholder Directory

ADVERTISEMENT

20

013

Pennsylv

vania Departm

ment of Reve

enue

I

nstruct

tions fo

or PA-2

20S/PA

A-65 Di

rectory

y

P

Partner/Me

ember/Sh

areholder

r Directory

y

Wh

hat’s New

w

Owners

hip Perce

entage

Line I

Instructi

ions

The d

department w

ill begin issuin

ng

Partnersh

hip

Reve

nue ID’s in th

his calendar ta

ax year.

If you

u received a le

etter with you

ur new

Enter the ow

wner’s percent

tage of

Li

ine 1 thro

ough 6

ten d

digit Revenue

ID, please be

gin

ownership at

t the close of

the taxable

using

g it on all appr

ropriate forms

s and

year.

Co

ode

sched

dules requirin

g this informa

ation.

En

nter the typ

e of owner

using the

PA S Corp

poration

fo

llowing codes

:

Note.

Corp

porations inclu

ude

Enter the ow

wner’s weighte

ed average

●

B = Bank Fin

nancial Institu

tion

percentage o

of ownership f

for the

limited liabi

ility companie

es.

●

PI = Part-Yea

ar Resident In

ndividual (S

taxable year

r.

corporation o

nly)

●

T = Trust

G

General I

Informat

tion

Name/A

Address

●

DE = Disrega

arded Entity

Enter the co

mplete name,

, address,

●

I = Insuranc

e Company

city, state an

nd ZIP code o

of the

Pur

rpose of

f Form

●

P = Partners

hip

partner/mem

mber/shareho

lder involved

●

S = S Corpor

ration

PA S

corporations,

partnerships

or

with the ent

ity within the

tax year.

●

RI = Residen

nt Individual

limite

ed liability com

mpanies filing

as

●

L = LLC taxe

ed as a Partne

rship

partn

nerships or PA

A S corporation

ns for

Note

e.

To list addit

tional owners

feder

ral income tax

x purposes use

e PA-

●

LC = LLC tax

xed as a C Cor

rporation

make

e a copy of the

e Directory.

20S/

PA-65 Partner

r/Member/

●

LS = LLC tax

xed as an PA S

S

Share

eholder Direct

tory to list eac

ch

Corporation

partn

ner/member/s

shareholder (o

owner)

●

C = C Corpor

ration

involv

ved with the e

entity within t

the tax

●

NR = Nonres

sident Individu

ual

year.

●

E = Estate

●

X = Exempt

Co

mpleting

g the Par

rtner/

S

SN/FEIN

M

Member/S

Sharehol

lder

En

nter the applic

cable nine-dig

it Social

Se

ecurity numbe

er or nine-digi

t federal

Dire

ectory

em

mployer identi

ification numb

ber (FEIN)

of

f each partner/

r/member/

Bus

siness Na

ame

sh

hareholder.

Enter

r the complete

e name of the

e entity

R

Revenue ID

D

or bu

usiness as sho

own on the PA

-

En

nter the Reven

nue ID of the

PA S

20S/

PA-65 Inform

ation Return.

co

orporation or l

imited liability

y company.

The

e entity must

list its partne

rs/

If

the entity has

s neither a Ta

ax Account ID

mem

bers/shareho

lders on this

no

or a Revenue

ID, leave the

field blank.

sched

dule.

FEI

IN

Caution

n.

Do not use

the tax

number

assigned by t

the

Enter

r the nine-digi

it federal emp

ployer

ident

tification numb

ber (FEIN) of

the

De

epartment of

State.

entity

y or business

as shown on

the PA-

20S/

PA-65 Inform

ation Return.

Note.

Th

he Revenue ID

D is not

C

omplete all of

f the following

g for all

applicab

le to an indivi

idual since,

partn

ners/members

s/shareholders

s.

fo

r Pennsylvani

a purposes, in

ndividuals

ar

re identified by

y their Social

Security

nu

umber only. A

As a result, for

r

Pe

ennsylvania pe

ersonal incom

me tax

pu

urposes, the P

PA Account # w

would not

ap

pply to the foll

lowing codes:

PI, T, NR,

P,

E, L and RI.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1