Form Mt-39 - Alcoholic Beverages Tax Clearance Return For Tax On Importation Of Alcoholic Beverages Into New York State For Personal Consumption

ADVERTISEMENT

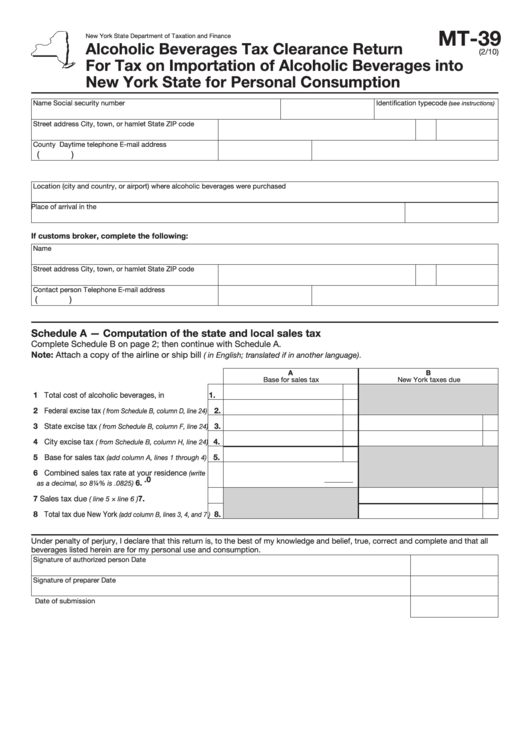

MT-39

New York State Department of Taxation and Finance

Alcoholic Beverages Tax Clearance Return

(2/10)

For Tax on Importation of Alcoholic Beverages into

New York State for Personal Consumption

Name

Social security number

Identification type code

(see instructions)

Street address

City, town, or hamlet

State ZIP code

County

Daytime telephone

E-mail address

(

)

Location (city and country, or airport) where alcoholic beverages were purchased

Place of arrival in the U.S.

Date of arrival

If customs broker, complete the following:

Name

Street address

City, town, or hamlet

State ZIP code

Contact person

Telephone

E-mail address

(

)

Schedule A — Computation of the state and local sales tax

Complete Schedule B on page 2; then continue with Schedule A.

Note: Attach a copy of the airline or ship bill

( in English; translated if in another language).

A

B

Base for sales tax

New York taxes due

1 Total cost of alcoholic beverages, in U.S. dollars

1.

2 Federal excise tax

2.

( from Schedule B, column D, line 24)

3 State excise tax

3.

( from Schedule B, column F, line 24)

4 City excise tax

4.

( from Schedule B, column H, line 24)

5 Base for sales tax

5.

(add column A, lines 1 through 4)

6 Combined sales tax rate at your residence

(write

.0

.........................

6.

as a decimal, so 8¼% is .0825)

7 Sales tax due

............................

7.

( line 5 × line 6 )

8 Total tax due New York

8.

(add column B, lines 3, 4, and 7 )

Under penalty of perjury, I declare that this return is, to the best of my knowledge and belief, true, correct and complete and that all

beverages listed herein are for my personal use and consumption.

Signature of authorized person

Date

Signature of preparer

Date

Date of submission

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3