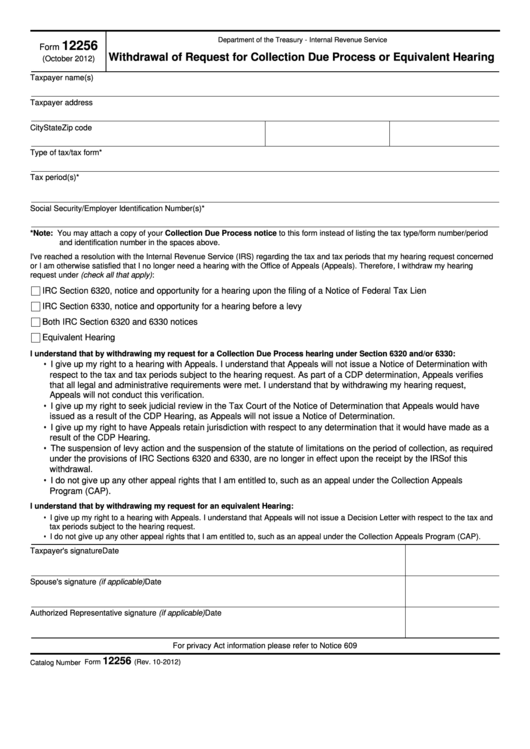

Department of the Treasury - Internal Revenue Service

12256

Form

Withdrawal of Request for Collection Due Process or Equivalent Hearing

(October 2012)

Taxpayer name(s)

Taxpayer address

City

State

Zip code

Type of tax/tax form*

Tax period(s)*

Social Security/Employer Identification Number(s)*

*Note: You may attach a copy of your Collection Due Process notice to this form instead of listing the tax type/form number/period

and identification number in the spaces above.

I've reached a resolution with the Internal Revenue Service (IRS) regarding the tax and tax periods that my hearing request concerned

or I am otherwise satisfied that I no longer need a hearing with the Office of Appeals (Appeals). Therefore, I withdraw my hearing

request under (check all that apply):

IRC Section 6320, notice and opportunity for a hearing upon the filing of a Notice of Federal Tax Lien

IRC Section 6330, notice and opportunity for a hearing before a levy

Both IRC Section 6320 and 6330 notices

Equivalent Hearing

I understand that by withdrawing my request for a Collection Due Process hearing under Section 6320 and/or 6330:

• I give up my right to a hearing with Appeals. I understand that Appeals will not issue a Notice of Determination with

respect to the tax and tax periods subject to the hearing request. As part of a CDP determination, Appeals verifies

that all legal and administrative requirements were met. I understand that by withdrawing my hearing request,

Appeals will not conduct this verification.

• I give up my right to seek judicial review in the Tax Court of the Notice of Determination that Appeals would have

issued as a result of the CDP Hearing, as Appeals will not issue a Notice of Determination.

• I give up my right to have Appeals retain jurisdiction with respect to any determination that it would have made as a

result of the CDP Hearing.

• The suspension of levy action and the suspension of the statute of limitations on the period of collection, as required

under the provisions of IRC Sections 6320 and 6330, are no longer in effect upon the receipt by the IRS of this

withdrawal.

• I do not give up any other appeal rights that I am entitled to, such as an appeal under the Collection Appeals

Program (CAP).

I understand that by withdrawing my request for an equivalent Hearing:

• I give up my right to a hearing with Appeals. I understand that Appeals will not issue a Decision Letter with respect to the tax and

tax periods subject to the hearing request.

• I do not give up any other appeal rights that I am entitled to, such as an appeal under the Collection Appeals Program (CAP).

Taxpayer's signature

Date

Spouse's signature (if applicable)

Date

Authorized Representative signature (if applicable)

Date

For privacy Act information please refer to Notice 609

12256

Form

(Rev. 10-2012)

Catalog Number 27779K

1

1