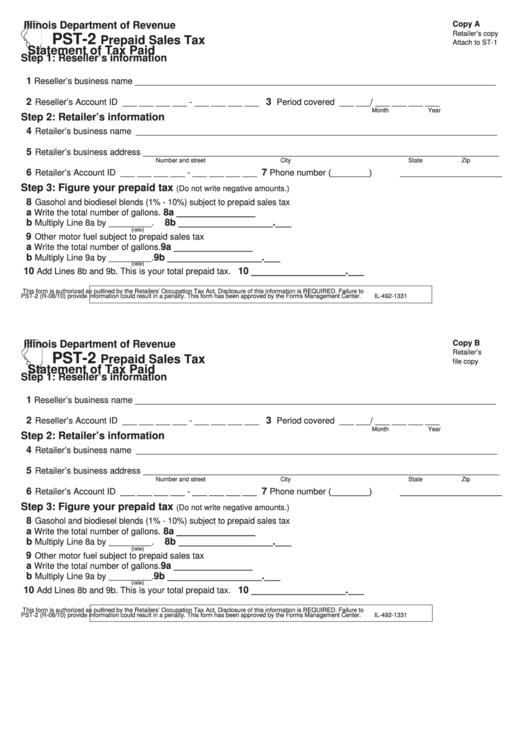

Illinois Department of Revenue

Copy A

Retailer’s copy

PST-2

Prepaid Sales Tax

Attach to ST-1

Statement of Tax Paid

Step 1: Reseller’s information

1

Reseller’s business name ____________________________________________________________________________

2

3

Reseller’s Account ID ___ ___ ___ ___ - ___ ___ ___ ___

Period covered ___ ___/ ___ ___ ___ ___

Month

Year

Step 2: Retailer’s information

4

Retailer’s business name ____________________________________________________________________________

5

Retailer’s business address ___________________________________________________________________________

Number and street

City

State

Zip

6

7

Retailer’s Account ID ___ ___ ___ ___ - ___ ___ ___ ___

Phone number (________)_____________________

Step 3: Figure your prepaid tax

(Do not write negative amounts.)

8

Gasohol and biodiesel blends (1% - 10%) subject to prepaid sales tax

a

8a _ ______________

Write the total number of gallons.

b

8b __________________.___

Multiply Line 8a by _________.

(rate)

9

Other motor fuel subject to prepaid sales tax

a

9a _______________

Write the total number of gallons.

b

9b __________________.___

Multiply Line 9a by _________.

(rate)

1 0

10 __________________.___

Add Lines 8b and 9b. This is your total prepaid tax.

This form is authorized as outlined by the Retailers’ Occupation Tax Act. Disclosure of this information is REQUIRED. Failure to

PST-2 (R-08/10)

provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-1331

Illinois Department of Revenue

Copy B

Retailer’s

PST-2

Prepaid Sales Tax

file copy

Statement of Tax Paid

Step 1: Reseller’s information

1

Reseller’s business name ____________________________________________________________________________

2

3

Reseller’s Account ID ___ ___ ___ ___ - ___ ___ ___ ___

Period covered ___ ___/ ___ ___ ___ ___

Month

Year

Step 2: Retailer’s information

4

Retailer’s business name ____________________________________________________________________________

5

Retailer’s business address ___________________________________________________________________________

Number and street

City

State

Zip

6

7

Retailer’s Account ID ___ ___ ___ ___ - ___ ___ ___ ___

Phone number (________)_____________________

Step 3: Figure your prepaid tax

(Do not write negative amounts.)

8

Gasohol and biodiesel blends (1% - 10%) subject to prepaid sales tax

a

8a _ ______________

Write the total number of gallons.

b

8b __________________.___

Multiply Line 8a by _________.

(rate)

9

Other motor fuel subject to prepaid sales tax

a

9a _______________

Write the total number of gallons.

b

9b __________________.___

Multiply Line 9a by _________.

(rate)

1 0

10 __________________.___

Add Lines 8b and 9b. This is your total prepaid tax.

This form is authorized as outlined by the Retailers’ Occupation Tax Act. Disclosure of this information is REQUIRED. Failure to

PST-2 (R-08/10)

provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-1331

1

1 2

2