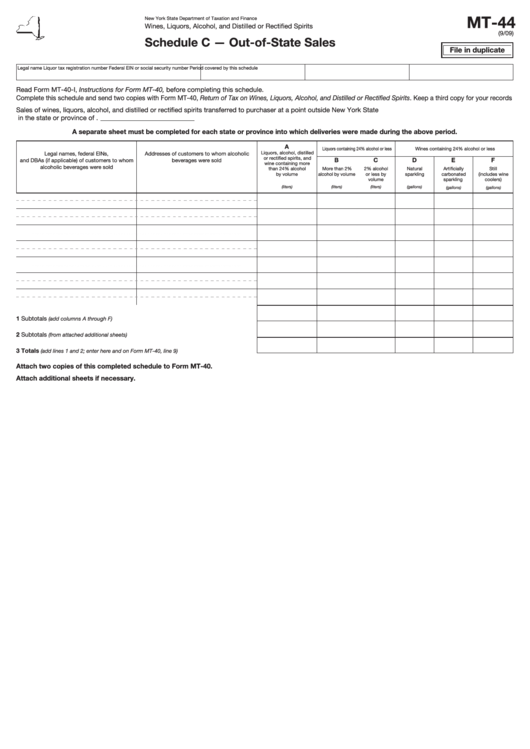

Form Mt-44 Schedule C - Out-Of-State Sales

ADVERTISEMENT

MT-44

New York State Department of Taxation and Finance

Wines, Liquors, Alcohol, and Distilled or Rectified Spirits

(9/09)

Schedule C — Out-of-State Sales

File in duplicate

Legal name

Liquor tax registration number

Federal EIN or social security number

Period covered by this schedule

Read Form MT-40-I, Instructions for Form MT-40, before completing this schedule.

Complete this schedule and send two copies with Form MT-40, Return of Tax on Wines, Liquors, Alcohol, and Distilled or Rectified Spirits. Keep a third copy for your records.

Sales of wines, liquors, alcohol, and distilled or rectified spirits transferred to purchaser at a point outside New York State

in the state or province of

.

A separate sheet must be completed for each state or province into which deliveries were made during the above period.

A

Liquors containing 24% alcohol or less

Wines containing 24% alcohol or less

Liquors, alcohol, distilled

Legal names, federal EINs,

Addresses of customers to whom alcoholic

or rectified spirits, and

B

C

D

E

F

and DBAs (if applicable) of customers to whom

beverages were sold

wine containing more

alcoholic beverages were sold

than 24% alcohol

More than 2%

2% alcohol

Natural

Artificially

Still

by volume

alcohol by volume

or less by

sparkling

carbonated

(includes wine

volume

sparkling

coolers)

(liters)

(liters)

(liters)

(gallons)

(gallons)

(gallons)

1

Subtotals

.................................................................................

(add columns A through F)

2

Subtotals

........................................................................

(from attached additional sheets)

3

Totals

...........................................

(add lines 1 and 2; enter here and on Form MT-40, line 9)

Attach two copies of this completed schedule to Form MT-40.

Attach additional sheets if necessary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1