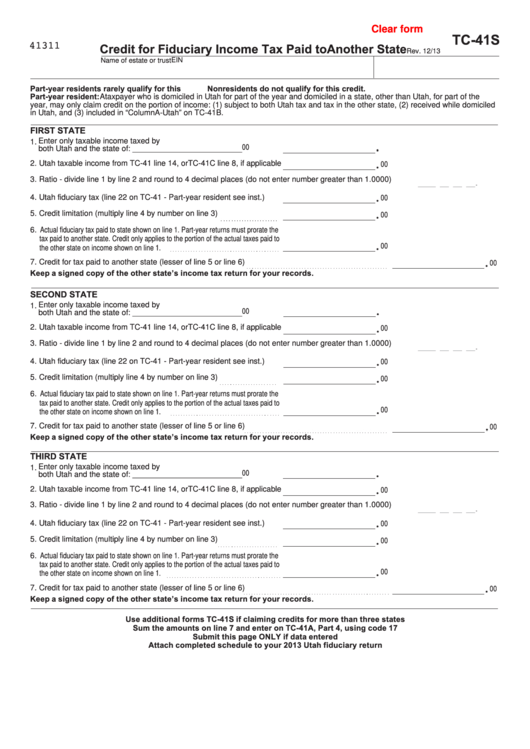

Clear form

TC-41S

41311

Credit for Fiduciary Income Tax Paid to Another State

Rev. 12/13

EIN

Name of estate or trust

Part-year residents rarely qualify for this credit.

Nonresidents do not qualify for this credit.

See instructions.

Part-year resident:

A taxpayer who is domiciled in Utah for part of the year and domiciled in a state, other than Utah, for part of the

year, may only claim credit on the portion of income: (1) subject to both Utah tax and tax in the other state, (2) received while domiciled

in Utah, and (3) included in “Column A-Utah” on TC-41B.

FIRST STATE

Enter only taxable income taxed by

1.

00

both Utah and the state of: _________________________

00

2. Utah taxable income from TC-41 line 14, or TC-41C line 8, if applicable

3. Ratio - divide line 1 by line 2 and round to 4 decimal places (do not enter number greater than 1.0000)

.

__ __ __ __ __

00

4. Utah fiduciary tax (line 22 on TC-41 - Part-year resident see inst.)

5. Credit limitation (multiply line 4 by number on line 3)

00

6. Actual fiduciary tax paid to state shown on line 1. Part-year returns must prorate the

tax paid to another state. Credit only applies to the portion of the actual taxes paid to

00

the other state on income shown on line 1.

00

7. Credit for tax paid to another state (lesser of line 5 or line 6)

Keep a signed copy of the other state’s income tax return for your records.

SECOND STATE

Enter only taxable income taxed by

1.

00

both Utah and the state of: _________________________

00

2. Utah taxable income from TC-41 line 14, or TC-41C line 8, if applicable

3. Ratio - divide line 1 by line 2 and round to 4 decimal places (do not enter number greater than 1.0000)

.

__ __ __ __ __

00

4. Utah fiduciary tax (line 22 on TC-41 - Part-year resident see inst.)

5. Credit limitation (multiply line 4 by number on line 3)

00

6. Actual fiduciary tax paid to state shown on line 1. Part-year returns must prorate the

tax paid to another state. Credit only applies to the portion of the actual taxes paid to

00

the other state on income shown on line 1.

00

7. Credit for tax paid to another state (lesser of line 5 or line 6)

Keep a signed copy of the other state’s income tax return for your records.

THIRD STATE

Enter only taxable income taxed by

1.

00

both Utah and the state of: _________________________

2. Utah taxable income from TC-41 line 14, or TC-41C line 8, if applicable

00

3. Ratio - divide line 1 by line 2 and round to 4 decimal places (do not enter number greater than 1.0000)

.

__ __ __ __ __

00

4. Utah fiduciary tax (line 22 on TC-41 - Part-year resident see inst.)

5. Credit limitation (multiply line 4 by number on line 3)

00

6. Actual fiduciary tax paid to state shown on line 1. Part-year returns must prorate the

tax paid to another state. Credit only applies to the portion of the actual taxes paid to

00

the other state on income shown on line 1.

00

7. Credit for tax paid to another state (lesser of line 5 or line 6)

Keep a signed copy of the other state’s income tax return for your records.

Use additional forms TC-41S if claiming credits for more than three states

Sum the amounts on line 7 and enter on TC-41A, Part 4, using code 17

Submit this page ONLY if data entered

Attach completed schedule to your 2013 Utah fiduciary return

1

1