└

┘

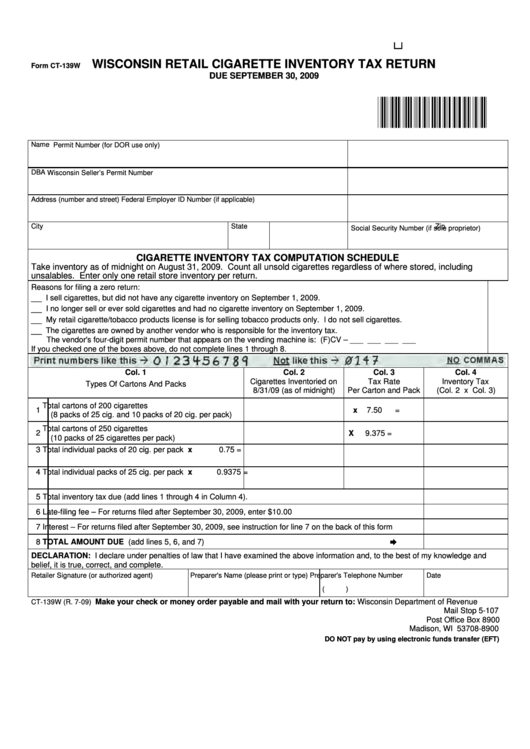

WISCONSIN RETAIL CIGARETTE INVENTORY TAX RETURN

Form CT-139W

DUE SEPTEMBER 30, 2009

Name

Permit Number (for DOR use only)

DBA

Wisconsin Seller’s Permit Number

Address (number and street)

Federal Employer ID Number (if applicable)

City

State

Zip Code

Social Security Number (if sole proprietor)

CIGARETTE INVENTORY TAX COMPUTATION SCHEDULE

Take inventory as of midnight on August 31, 2009. Count all unsold cigarettes regardless of where stored, including

unsalables. Enter only one retail store inventory per return.

Reasons for filing a zero return:

__

I sell cigarettes, but did not have any cigarette inventory on September 1, 2009.

__

I no longer sell or ever sold cigarettes and had no cigarette inventory on September 1, 2009.

__

My retail cigarette/tobacco products license is for selling tobacco products only. I do not sell cigarettes.

__

The cigarettes are owned by another vendor who is responsible for the inventory tax.

The vendor's four-digit permit number that appears on the vending machine is: (F)CV – ___ ___ ___ ___

If you checked one of the boxes above, do not complete lines 1 through 8.

Col. 1

Col. 2

Col. 3

Col. 4

Cigarettes Inventoried on

Tax Rate

Inventory Tax

Types Of Cartons And Packs

8/31/09 (as of midnight)

Per Carton and Pack

(Col. 2 x Col. 3)

Total cartons of 200 cigarettes

1

x

7.50

=

(8 packs of 25 cig. and 10 packs of 20 cig. per pack)

Total cartons of 250 cigarettes

2

X

9.375

=

(10 packs of 25 cigarettes per pack)

3

Total individual packs of 20 cig. per pack

x

0.75

=

4

Total individual packs of 25 cig. per pack

x

0.9375 =

5

Total inventory tax due (add lines 1 through 4 in Column 4).

6

Late-filing fee – For returns filed after September 30, 2009, enter $10.00

7

Interest – For returns filed after September 30, 2009, see instruction for line 7 on the back of this form

8

TOTAL AMOUNT DUE (add lines 5, 6, and 7)

DECLARATION: I declare under penalties of law that I have examined the above information and, to the best of my knowledge and

belief, it is true, correct, and complete.

Retailer Signature (or authorized agent)

Preparer's Name (please print or type)

Preparer's Telephone Number

Date

(

)

Make your check or money order payable and mail with your return to: Wisconsin Department of Revenue

CT-139W (R. 7-09)

Mail Stop 5-107

Post Office Box 8900

Madison, WI 53708-8900

DO NOT pay by using electronic funds transfer (EFT)

1

1 2

2