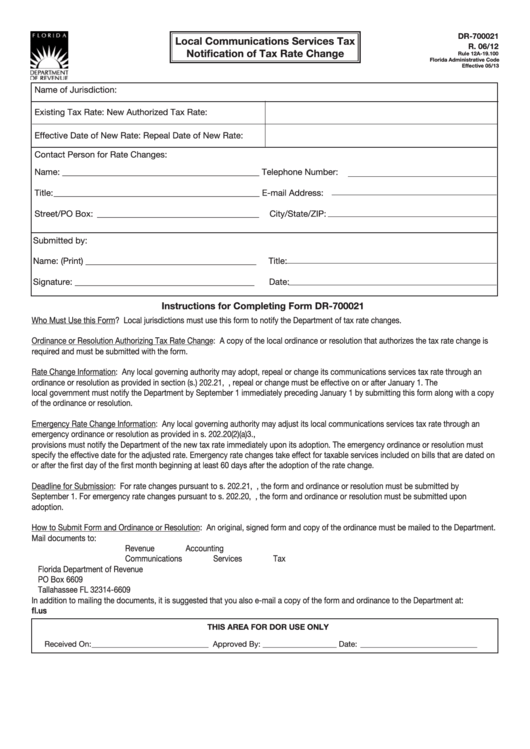

DR-700021

Local Communications Services Tax

R. 06/12

Notification of Tax Rate Change

Rule 12A-19.100

Florida Administrative Code

Effective 05/13

Name of Jurisdiction:

Existing Tax Rate:

New Authorized Tax Rate:

Effective Date of New Rate:

Repeal Date of New Rate:

Contact Person for Rate Changes:

Name: _____________________________________________

Telephone Number:

Title: _______________________________________________

E-mail Address:

Street/PO Box: _____________________________________

City/State/ZIP:

Submitted by:

Name: (Print) _______________________________________

Title:

Signature: _________________________________________

Date:

Instructions for Completing Form DR-700021

Who Must Use this Form? Local jurisdictions must use this form to notify the Department of tax rate changes.

Ordinance or Resolution Authorizing Tax Rate Change: A copy of the local ordinance or resolution that authorizes the tax rate change is

required and must be submitted with the form.

Rate Change Information: Any local governing authority may adopt, repeal or change its communications services tax rate through an

ordinance or resolution as provided in section (s.) 202.21, F.S. The adoption, repeal or change must be effective on or after January 1. The

local government must notify the Department by September 1 immediately preceding January 1 by submitting this form along with a copy

of the ordinance or resolution.

Emergency Rate Change Information: Any local governing authority may adjust its local communications services tax rate through an

emergency ordinance or resolution as provided in s. 202.20(2)(a)3., F.S. A local governing authority that adjusts its rate through emergency

provisions must notify the Department of the new tax rate immediately upon its adoption. The emergency ordinance or resolution must

specify the effective date for the adjusted rate. Emergency rate changes take effect for taxable services included on bills that are dated on

or after the first day of the first month beginning at least 60 days after the adoption of the rate change.

Deadline for Submission: For rate changes pursuant to s. 202.21, F.S., the form and ordinance or resolution must be submitted by

September 1. For emergency rate changes pursuant to s. 202.20, F.S., the form and ordinance or resolution must be submitted upon

adoption.

How to Submit Form and Ordinance or Resolution: An original, signed form and copy of the ordinance must be mailed to the Department.

Mail documents to:

Revenue Accounting

Communications Services Tax

Florida Department of Revenue

PO Box 6609

Tallahassee FL 32314-6609

In addition to mailing the documents, it is suggested that you also e-mail a copy of the form and ordinance to the Department at:

revenueaccounting@dor.state.fl.us

THIS AREA FOR DOR USE ONLY

Received On: ______________________________ Approved By: ___________________

Date: ______________________________

1

1