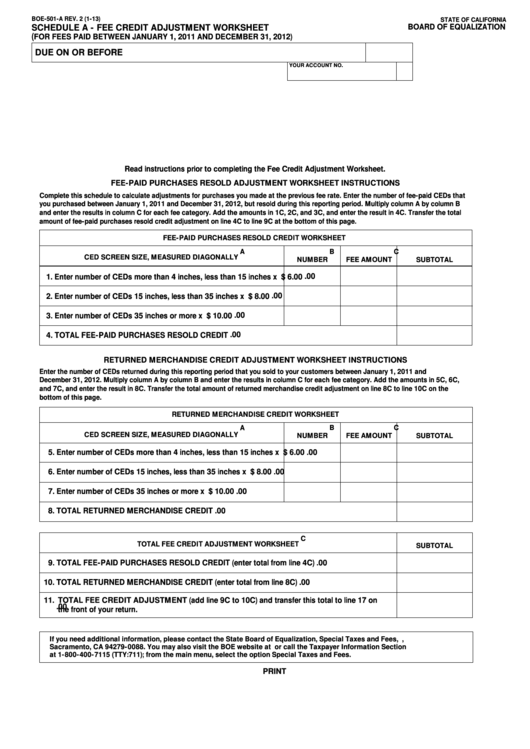

BOE-501-A REV. 2 (1-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

SCHEDULE A - FEE CREDIT ADJUSTMENT WORKSHEET

(

FOR FEES PAID BETWEEN JANUARY 1, 2011 AND DECEMBER 31, 2012)

DUE ON OR BEFORE

YOUR ACCOUNT NO.

Read instructions prior to completing the Fee Credit Adjustment Worksheet.

FEE-PAID PURCHASES RESOLD ADJUSTMENT WORKSHEET INSTRUCTIONS

Complete this schedule to calculate adjustments for purchases you made at the previous fee rate. Enter the number of fee-paid CEDs that

you purchased between January 1, 2011 and December 31, 2012, but resold during this reporting period. Multiply column A by column B

and enter the results in column C for each fee category. Add the amounts in 1C, 2C, and 3C, and enter the result in 4C. Transfer the total

amount of fee-paid purchases resold credit adjustment on line 4C to line 9C at the bottom of this page.

FEE-PAID PURCHASES RESOLD CREDIT WORKSHEET

A

B

C

CED SCREEN SIZE, MEASURED DIAGONALLY

NUMBER

FEE AMOUNT

SUBTOTAL

.00

1. Enter number of CEDs more than 4 inches, less than 15 inches

x $ 6.00

.00

2. Enter number of CEDs 15 inches, less than 35 inches

x $ 8.00

.00

3. Enter number of CEDs 35 inches or more

x $ 10.00

.00

4. TOTAL FEE-PAID PURCHASES RESOLD CREDIT

RETURNED MERCHANDISE CREDIT ADJUSTMENT WORKSHEET INSTRUCTIONS

Enter the number of CEDs returned during this reporting period that you sold to your customers between January 1, 2011 and

December 31, 2012. Multiply column A by column B and enter the results in column C for each fee category. Add the amounts in 5C, 6C,

and 7C, and enter the result in 8C. Transfer the total amount of returned merchandise credit adjustment on line 8C to line 10C on the

bottom of this page.

RETURNED MERCHANDISE CREDIT WORKSHEET

A

B

C

CED SCREEN SIZE, MEASURED DIAGONALLY

NUMBER

FEE AMOUNT

SUBTOTAL

5. Enter number of CEDs more than 4 inches, less than 15 inches

x $ 6.00

.00

6. Enter number of CEDs 15 inches, less than 35 inches

x $ 8.00

.00

7. Enter number of CEDs 35 inches or more

x $ 10.00

.00

8. TOTAL RETURNED MERCHANDISE CREDIT

.00

C

TOTAL FEE CREDIT ADJUSTMENT WORKSHEET

SUBTOTAL

9. TOTAL FEE-PAID PURCHASES RESOLD CREDIT (enter total from line 4C)

.00

10. TOTAL RETURNED MERCHANDISE CREDIT (enter total from line 8C)

.00

11.

TOTAL FEE CREDIT ADJUSTMENT (add line 9C to 10C) and transfer this total to line 17 on

.00

the front of your return.

If you need additional information, please contact the State Board of Equalization, Special Taxes and Fees, P.O. Box 942879,

Sacramento, CA 94279-0088. You may also visit the BOE website at or call the Taxpayer Information Section

at 1-800-400-7115 (TTY:711); from the main menu, select the option Special Taxes and Fees.

CLEAR

PRINT

1

1