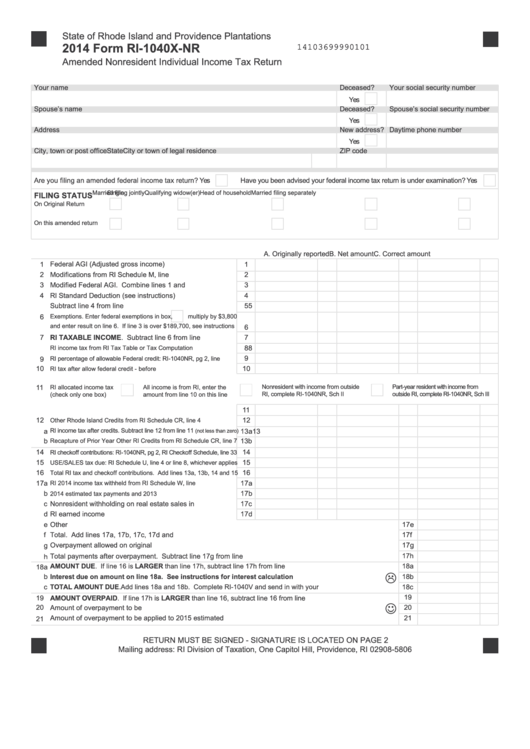

State of Rhode Island and Providence Plantations

2014 Form RI-1040X-NR

14103699990101

Amended Nonresident Individual Income Tax Return

Your name

Deceased?

Your social security number

Yes

Spouse’s name

Deceased?

Spouse’s social security number

Yes

Address

New address?

Daytime phone number

Yes

City, town or post office

State

ZIP code

City or town of legal residence

Are you filing an amended federal income tax return?

Have you been advised your federal income tax return is under examination?

Yes

Yes

Single

Married filing jointly

Married filing separately

Head of household

Qualifying widow(er)

FILING STATUS

On Original Return

On this amended return

A. Originally reported

B. Net amount

C. Correct amount

1

Federal AGI (Adjusted gross income)......................................

1

2

Modifications from RI Schedule M, line 3 ................................

2

3

Modified Federal AGI. Combine lines 1 and 2 ........................

3

4

RI Standard Deduction (see instructions)................................

4

5

Subtract line 4 from line 3........................................................

5

6

Exemptions. Enter federal exemptions in box,

multiply by $3,800

and enter result on line 6. If line 3 is over $189,700, see instructions

6

7

RI TAXABLE INCOME. Subtract line 6 from line 5................

7

8

8

RI income tax from RI Tax Table or Tax Computation Worksheet.........

9

RI percentage of allowable Federal credit: RI-1040NR, pg 2, line 25......

9

10

10

RI tax after allow federal credit - before allocation................................

Nonresident with income from outside

Part-year resident with income from

11

RI allocated income tax

All income is from RI, enter the

(check only one box)

amount from line 10 on this line

RI, complete RI-1040NR, Sch II

outside RI, complete RI-1040NR, Sch III

11

12

12

Other Rhode Island Credits from RI Schedule CR, line 4 ....................

RI income tax after credits. Subtract line 12 from line 11

13

13a

a

(not less than zero)

b

13b

Recapture of Prior Year Other RI Credits from RI Schedule CR, line 7

14

RI checkoff contributions: RI-1040NR, pg 2, RI Checkoff Schedule, line 33

14

15

15

USE/SALES tax due: RI Schedule U, line 4 or line 8, whichever applies

16

16

Total RI tax and checkoff contributions. Add lines 13a, 13b, 14 and 15

17

17a

a

RI 2014 income tax withheld from RI Schedule W, line 16....................

17b

2014 estimated tax payments and 2013 carryforward..........................

c

Nonresident withholding on real estate sales in 2014.............

17c

d

RI earned income credit..........................................................

17d

e

Other payments...........................................................................................................................................................

17e

f

Total. Add lines 17a, 17b, 17c, 17d and 17e............................................................................................................... 17f

g

Overpayment allowed on original return...................................................................................................................... 17g

Total payments after overpayment. Subtract line 17g from line 17f............................................................................ 17h

h

AMOUNT DUE. If line 16 is LARGER than line 17h, subtract line 17h from line 16............................................

18a

18

a

L

b

Interest due on amount on line 18a. See instructions for interest calculation .........................................

18b

c

TOTAL AMOUNT DUE. Add lines 18a and 18b. Complete RI-1040V and send in with your payment............

18c

19

19

AMOUNT OVERPAID. If line 17h is LARGER than line 16, subtract line 16 from line 17h...............................

☺

20

Amount of overpayment to be refunded..........................................................................................................

20

Amount of overpayment to be applied to 2015 estimated tax.........................................................................

21

21

RETURN MUST BE SIGNED - SIGNATURE IS LOCATED ON PAGE 2

Mailing address: RI Division of Taxation, One Capitol Hill, Providence, RI 02908-5806

1

1 2

2