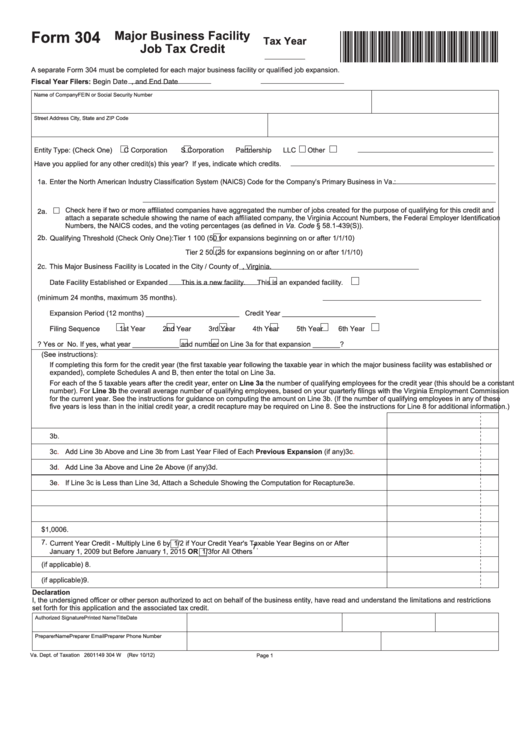

Form 304

Major Business Facility

*VA0304112888*

Tax Year

Job Tax Credit

A separate Form 304 must be completed for each major business facility or qualified job expansion.

Fiscal Year Filers: Begin Date

, and End Date

Name of Company

FEIN or Social Security Number

Street Address

City, State and ZIP Code

Entity Type: (Check One)

C Corporation

S Corporation

Partnership

LLC

Other

Have you applied for any other credit(s) this year? If yes, indicate which credits.

1a. Enter the North American Industry Classification System (NAICS) Code for the Company’s Primary Business in Va.:

1b. Enter the Industry Description

Check here if two or more affiliated companies have aggregated the number of jobs created for the purpose of qualifying for this credit and

2a.

attach a separate schedule showing the name of each affiliated company, the Virginia Account Numbers, the Federal Employer Identification

Numbers, the NAICS codes, and the voting percentages (as defined in Va. Code § 58.1-439(S)).

2b. Qualifying Threshold (Check Only One):

Tier 1

100 (50 for expansions beginning on or after 1/1/10)

Tier 2

50 (25 for expansions beginning on or after 1/1/10)

2c. This Major Business Facility is Located in the City / County of

, Virginia.

Date Facility Established or Expanded

This is a new facility.

This is an expanded facility.

2d. Date Range from Which the Credit is Based (minimum 24 months, maximum 35 months)

.

Expansion Period (12 months) ________________________ Credit Year ________________________

Filing Sequence

1st Year

2nd Year

3rd Year

4th Year

5th Year

6th Year

2e. Have you ever had an expansion before?

Yes or

No. If yes, what year ____________ and number on Line 3a for that expansion _______?

3. Number of Qualifying Employees (See instructions):

If completing this form for the credit year (the first taxable year following the taxable year in which the major business facility was established or

expanded), complete Schedules A and B, then enter the total on Line 3a.

For each of the 5 taxable years after the credit year, enter on Line 3a the number of qualifying employees for the credit year (this should be a constant

number). For Line 3b the overall average number of qualifying employees, based on your quarterly filings with the Virginia Employment Commission

for the current year. See the instructions for guidance on computing the amount on Line 3b. (If the number of qualifying employees in any of these

five years is less than in the initial credit year, a credit recapture may be required on Line 8. See the instructions for Line 8 for additional information.)

3a. Number of Qualifying Employees in the Credit Year

3a.

3b. Overall Average Number of Qualifying Employees in the Current Year for This Expansion

3b.

3c.

Add Line 3b Above and Line 3b from Last Year Filed of Each Previous Expansion (if any)

3c.

3d.

Add Line 3a Above and Line 2e Above (if any)

3d.

3e.

If Line 3c is Less than Line 3d, Attach a Schedule Showing the Computation for Recapture

3e.

4. Threshold Amount - Enter the Amount from 2b

4.

5. Number of Credit Year Qualifying Employees - Subtract Line 4 from Line 3a

5.

6. Total Credit Allowed for this Major Business Facility or Expansion - Multiply Line 5 by $1,000

6.

7. Current Year Credit - Multiply Line 6 by

1/2 if Your Credit Year's Taxable Year Begins on or After

7.

January 1, 2009 but Before January 1, 2015 OR

1/3 for All Others

8. Credit to Be Recaptured this Year (if applicable)

8.

9. Adjusted Credit - Subtract Line 8 from Line 7 (if applicable)

9.

Declaration

I, the undersigned officer or other person authorized to act on behalf of the business entity, have read and understand the limitations and restrictions

set forth for this application and the associated tax credit.

Authorized Signature

Printed Name

Title

Date

Preparer Name

Preparer Email

Preparer Phone Number

Va. Dept. of Taxation 2601149 304 W

(Rev 10/12)

Page 1

1

1 2

2 3

3 4

4 5

5 6

6