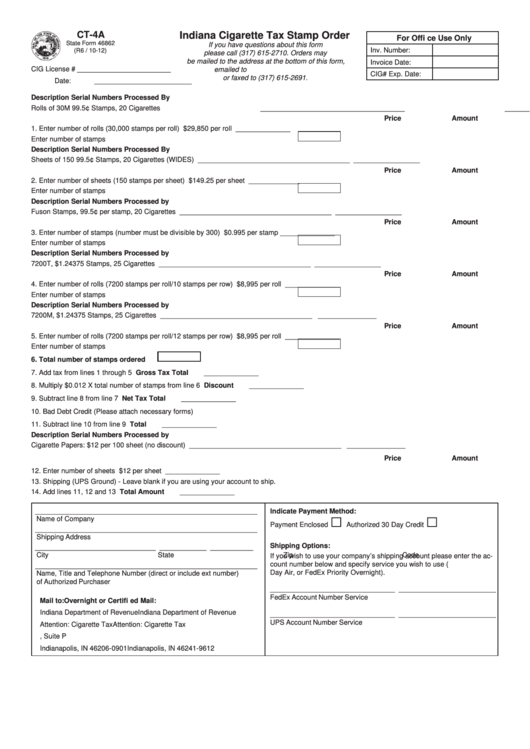

CT-4A

Indiana Cigarette Tax Stamp Order

For Offi ce Use Only

State Form 46862

If you have questions about this form

Inv. Number:

(R6 / 10-12)

please call (317) 615-2710. Orders may

be mailed to the address at the bottom of this form,

Invoice Date:

CIG License # ________________________

emailed to INCigTax@dor.in.gov

CIG# Exp. Date:

or faxed to (317) 615-2691.

Date: _________________________

Description

Serial Numbers

Processed By

Rolls of 30M 99.5¢ Stamps, 20 Cigarettes

_____________________________________

_________________

Price

Amount

1.

Enter number of rolls (30,000 stamps per roll) ................................................................................ _______ X $29,850 per roll

______________

Enter number of stamps ..........................................................................................

Description

Serial Numbers

Processed By

Sheets of 150 99.5¢ Stamps, 20 Cigarettes (WIDES)

_______________________________________

_________________

Price

Amount

2.

Enter number of sheets (150 stamps per sheet) ............................................................................. _______ X $149.25 per sheet _____________

Enter number of stamps ..........................................................................................

Description

Serial Numbers

Processed by

Fuson Stamps, 99.5¢ per stamp, 20 Cigarettes

_______________________________________

_________________

Price

Amount

3.

Enter number of stamps (number must be divisible by 300) ........................................................... _______ X $0.995 per stamp ______________

Enter number of stamps ..........................................................................................

Description

Serial Numbers

Processed by

7200T, $1.24375 Stamps, 25 Cigarettes

_______________________________________

_________________

Price

Amount

4.

Enter number of rolls (7200 stamps per roll/10 stamps per row) .................................................... _______ X $8,995 per roll

______________

Enter number of stamps ..........................................................................................

Description

Serial Numbers

Processed by

7200M, $1.24375 Stamps, 25 Cigarettes

_______________________________________

_______________

Price

Amount

5.

Enter number of rolls (7200 stamps per roll/12 stamps per row) .................................................... _______ X $8,995 per roll

______________

Enter number of stamps ..........................................................................................

6.

Total number of stamps ordered

7.

Add tax from lines 1 through 5 .......................................................................................................................... Gross Tax Total

______________

8.

Multiply $0.012 X total number of stamps from line 6 ...................................................................................................Discount

______________

9.

Subtract line 8 from line 7 ....................................................................................................................................... Net Tax Total

______________

10. Bad Debt Credit (Please attach necessary forms) .........................................................................................................................

______________

11. Subtract line 10 from line 9 ...................................................................................................................................................Total

______________

Description

Serial Numbers

Processed by

Cigarette Papers: $12 per 100 sheet (no discount)

_______________________________________

_______________

Price

Amount

12. Enter number of sheets ..................................................................................................................... _______ X $12 per sheet

______________

13. Shipping (UPS Ground) - Leave blank if you are using your account to ship. .............................................................................

______________

14. Add lines 11, 12 and 13 ......................................................................................................................................... Total Amount

______________

_________________________________________________________

Indicate Payment Method:

□

□

Name of Company

Payment Enclosed

Authorized 30 Day Credit

_________________________________________________________

Shipping Address

Shipping Options:

_______________________________ ____________

___________

City

State

Zip Code

If you wish to use your company’s shipping account please enter the ac-

count number below and specify service you wish to use (e.g. UPS Next

_________________________________________________________

Day Air, or FedEx Priority Overnight).

Name, Title and Telephone Number (direct or include ext number)

of Authorized Purchaser

________________________________ _________________________

FedEx Account Number

Service

Mail to:

Overnight or Certifi ed Mail:

Indiana Department of Revenue

Indiana Department of Revenue

________________________________ _________________________

UPS Account Number

Service

Attention: Cigarette Tax

Attention: Cigarette Tax

P.O. Box 901

7811 Milhouse Road, Suite P

Indianapolis, IN 46206-0901

Indianapolis, IN 46241-9612

1

1