Rev. 7/08

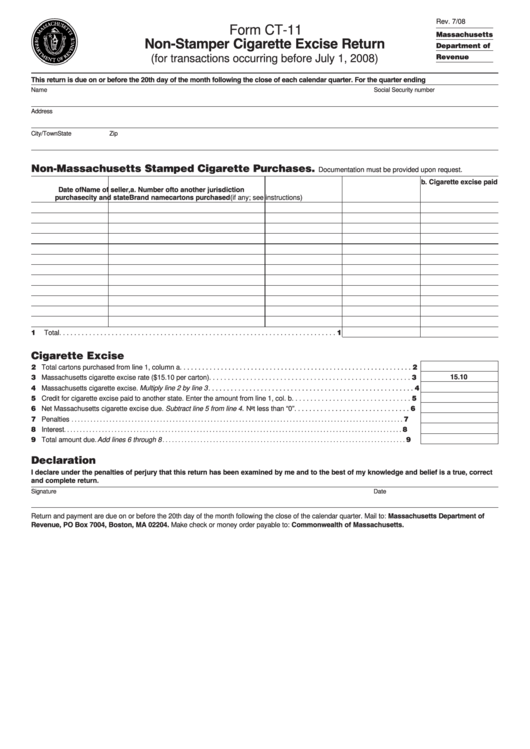

Form CT-11

Massachusetts

Non-Stamper Cigarette Excise Return

Department of

(for transactions occurring before July 1, 2008)

Revenue

This return is due on or before the 20th day of the month following the close of each calendar quarter. For the quarter ending

Name

Social Security number

Address

City/Town

State

Zip

Non-Massachusetts Stamped Cigarette Purchases.

Documentation must be provided upon request.

b. Cigarette excise paid

Date of

Name of seller,

a. Number of

to another jurisdiction

purchase

city and state

Brand name

cartons purchased

(if any; see instructions)

1

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Cigarette Excise

2 Total cartons purchased from line 1, column a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

15.10

3 Massachusetts cigarette excise rate ($15.10 per carton) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Massachusetts cigarette excise. Multiply line 2 by line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Credit for cigarette excise paid to another state. Enter the amount from line 1, col. b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Net Massachusetts cigarette excise due. Subtract line 5 from line 4. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Penalties

7

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Interest

8

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 Total amount due. Add lines 6 through 8

9

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Declaration

I declare under the penalties of perjury that this return has been examined by me and to the best of my knowledge and belief is a true, correct

and complete return.

Signature

Date

Return and payment are due on or before the 20th day of the month following the close of the calendar quarter. Mail to: Massachusetts Department of

Revenue, PO Box 7004, Boston, MA 02204. Make check or money order payable to: Commonwealth of Massachusetts.

1

1 2

2