Instructions For Form Dr-309632n - Wholesaler-Importer Fuel Tax Return - 2015

ADVERTISEMENT

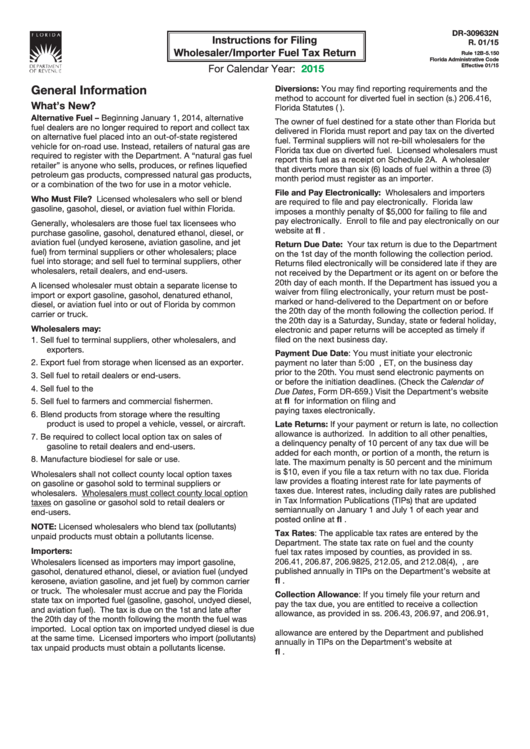

DR-309632N

Instructions for Filing

R. 01/15

Wholesaler/Importer Fuel Tax Return

Rule 12B-5.150

Florida Administrative Code

2015

Effective 01/15

For Calendar Year:

General Information

Diversions: You may find reporting requirements and the

method to account for diverted fuel in section (s.) 206.416,

What’s New?

Florida Statutes (F.S.).

Alternative Fuel – Beginning January 1, 2014, alternative

The owner of fuel destined for a state other than Florida but

fuel dealers are no longer required to report and collect tax

delivered in Florida must report and pay tax on the diverted

on alternative fuel placed into an out-of-state registered

fuel. Terminal suppliers will not re-bill wholesalers for the

vehicle for on-road use. Instead, retailers of natural gas are

Florida tax due on diverted fuel. Licensed wholesalers must

required to register with the Department. A “natural gas fuel

report this fuel as a receipt on Schedule 2A. A wholesaler

retailer” is anyone who sells, produces, or refines liquefied

that diverts more than six (6) loads of fuel within a three (3)

petroleum gas products, compressed natural gas products,

month period must register as an importer.

or a combination of the two for use in a motor vehicle.

File and Pay Electronically: Wholesalers and importers

Who Must File? Licensed wholesalers who sell or blend

are required to file and pay electronically. Florida law

gasoline, gasohol, diesel, or aviation fuel within Florida.

imposes a monthly penalty of $5,000 for failing to file and

pay electronically. Enroll to file and pay electronically on our

Generally, wholesalers are those fuel tax licensees who

website at

purchase gasoline, gasohol, denatured ethanol, diesel, or

aviation fuel (undyed kerosene, aviation gasoline, and jet

Return Due Date: Your tax return is due to the Department

fuel) from terminal suppliers or other wholesalers; place

on the 1st day of the month following the collection period.

fuel into storage; and sell fuel to terminal suppliers, other

Returns filed electronically will be considered late if they are

wholesalers, retail dealers, and end-users.

not received by the Department or its agent on or before the

20th day of each month. If the Department has issued you a

A licensed wholesaler must obtain a separate license to

waiver from filing electronically, your return must be post-

import or export gasoline, gasohol, denatured ethanol,

marked or hand-delivered to the Department on or before

diesel, or aviation fuel into or out of Florida by common

the 20th day of the month following the collection period. If

carrier or truck.

the 20th day is a Saturday, Sunday, state or federal holiday,

Wholesalers may:

electronic and paper returns will be accepted as timely if

filed on the next business day.

1.

Sell fuel to terminal suppliers, other wholesalers, and

exporters.

Payment Due Date: You must initiate your electronic

2.

Export fuel from storage when licensed as an exporter.

payment no later than 5:00 p.m., ET, on the business day

prior to the 20th. You must send electronic payments on

3.

Sell fuel to retail dealers or end-users.

or before the initiation deadlines. (Check the Calendar of

4.

Sell fuel to the U.S. Government.

Due Dates, Form DR-659.) Visit the Department’s website

at for information on filing and

5.

Sell fuel to farmers and commercial fishermen.

paying taxes electronically.

6.

Blend products from storage where the resulting

product is used to propel a vehicle, vessel, or aircraft.

Late Returns: If your payment or return is late, no collection

allowance is authorized. In addition to all other penalties,

7.

Be required to collect local option tax on sales of

a delinquency penalty of 10 percent of any tax due will be

gasoline to retail dealers and end-users.

added for each month, or portion of a month, the return is

8.

Manufacture biodiesel for sale or use.

late. The maximum penalty is 50 percent and the minimum

is $10, even if you file a tax return with no tax due. Florida

Wholesalers shall not collect county local option taxes

law provides a floating interest rate for late payments of

on gasoline or gasohol sold to terminal suppliers or

taxes due. Interest rates, including daily rates are published

wholesalers. Wholesalers must collect county local option

in Tax Information Publications (TIPs) that are updated

taxes on gasoline or gasohol sold to retail dealers or

semiannually on January 1 and July 1 of each year and

end-users.

posted online at

NOTE: Licensed wholesalers who blend tax (pollutants)

Tax Rates: The applicable tax rates are entered by the

unpaid products must obtain a pollutants license.

Department. The state tax rate on fuel and the county

Importers:

fuel tax rates imposed by counties, as provided in ss.

206.41, 206.87, 206.9825, 212.05, and 212.08(4), F.S., are

Wholesalers licensed as importers may import gasoline,

published annually in TIPs on the Department’s website at

gasohol, denatured ethanol, diesel, or aviation fuel (undyed

kerosene, aviation gasoline, and jet fuel) by common carrier

or truck. The wholesaler must accrue and pay the Florida

Collection Allowance: If you timely file your return and

state tax on imported fuel (gasoline, gasohol, undyed diesel,

pay the tax due, you are entitled to receive a collection

and aviation fuel). The tax is due on the 1st and late after

allowance, as provided in ss. 206.43, 206.97, and 206.91,

the 20th day of the month following the month the fuel was

F.S. The rate factors used to calculate the collection

imported. Local option tax on imported undyed diesel is due

allowance are entered by the Department and published

at the same time. Licensed importers who import (pollutants)

annually in TIPs on the Department’s website at

tax unpaid products must obtain a pollutants license.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12