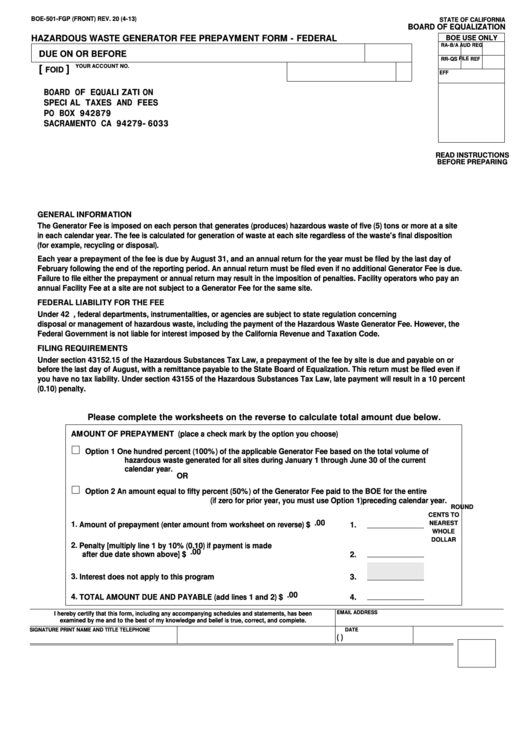

BOE-501-FGP (FRONT) REV. 20 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

HAZARDOUS WASTE GENERATOR FEE PREPAYMENT FORM - FEDERAL

BOE USE ONLY

AUD

RA-B/A

REG

DUE ON OR BEFORE

FILE

RR-QS

REF

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

SPECIAL TAXES AND FEES

PO BOX 942879

SACRAMENTO CA 94279-6033

READ INSTRUCTIONS

BEFORE PREPARING

GENERAL INFORMATION

The Generator Fee is imposed on each person that generates (produces) hazardous waste of five (5) tons or more at a site

in each calendar year. The fee is calculated for generation of waste at each site regardless of the waste's final disposition

(for example, recycling or disposal).

Each year a prepayment of the fee is due by August 31, and an annual return for the year must be filed by the last day of

February following the end of the reporting period. An annual return must be filed even if no additional Generator Fee is due.

Failure to file either the prepayment or annual return may result in the imposition of penalties. Facility operators who pay an

annual Facility Fee at a site are not subject to a Generator Fee for the same site.

FEDERAL LIABILITY FOR THE FEE

Under 42 U.S.C. section 6961, federal departments, instrumentalities, or agencies are subject to state regulation concerning

disposal or management of hazardous waste, including the payment of the Hazardous Waste Generator Fee. However, the

Federal Government is not liable for interest imposed by the California Revenue and Taxation Code.

FILING REQUIREMENTS

Under section 43152.15 of the Hazardous Substances Tax Law, a prepayment of the fee by site is due and payable on or

before the last day of August, with a remittance payable to the State Board of Equalization. This return must be filed even if

you have no tax liability. Under section 43155 of the Hazardous Substances Tax Law, late payment will result in a 10 percent

(0.10) penalty.

Please complete the worksheets on the reverse to calculate total amount due below.

AMOUNT OF PREPAYMENT (place a check mark by the option you choose)

Option 1

One hundred percent (100%) of the applicable Generator Fee based on the total volume of

hazardous waste generated for all sites during January 1 through June 30 of the current

calendar year.

OR

Option 2

An amount equal to fifty percent (50%) of the Generator Fee paid to the BOE for the entire

preceding calendar year

.

(if zero for prior year, you must use Option 1)

ROUND

CENTS TO

.00

1. Amount of prepayment (enter amount from worksheet on reverse)

NEAREST

1.

$

..................

WHOLE

DOLLAR

2. Penalty [multiply line 1 by 10% (0.10) if payment is made

.00

$

after due date shown above]

2.

...............................................................................

3. Interest does not apply to this program

3.

............................................................

.00

4. TOTAL AMOUNT DUE AND PAYABLE (add lines 1 and 2)

4.

$

................................

EMAIL ADDRESS

I hereby certify that this form, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is true, correct, and complete.

SIGNATURE

PRINT NAME AND TITLE

TELEPHONE

DATE

(

)

1

1 2

2