Instructions For Form Ct-001 - Wisconsin Cigarette Tax Refund Claim For Native American Tribes

ADVERTISEMENT

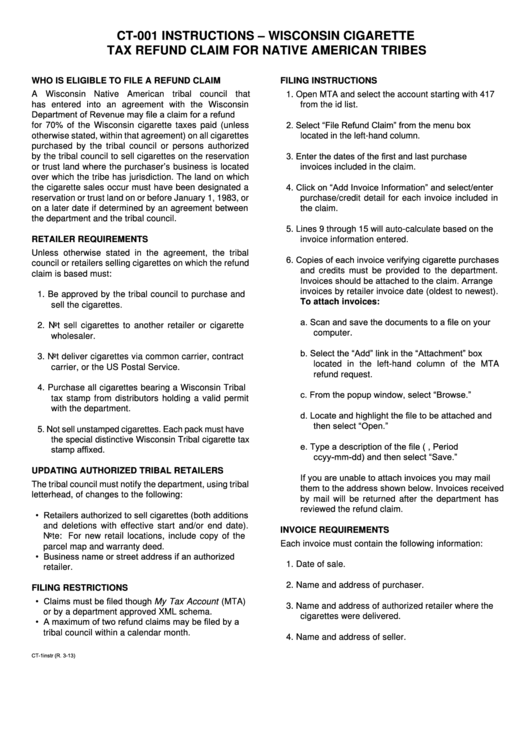

CT-001 INSTRUCTIONS – WISCONSIN CIGARETTE

TAX REFUND CLAIM FOR NATIVE AMERICAN TRIBES

WHO IS ELIGIBLE TO FILE A REFUND CLAIM

FILING INSTRUCTIONS

A Wisconsin Native American tribal council that

1. Open MTA and select the account starting with 417

has entered into an agreement with the Wisconsin

from the id list.

Department of Revenue may file a claim for a refund

2. Select “File Refund Claim” from the menu box

for 70% of the Wisconsin cigarette taxes paid (unless

otherwise stated, within that agreement) on all cigarettes

located in the left-hand column.

purchased by the tribal council or persons authorized

3. Enter the dates of the first and last purchase

by the tribal council to sell cigarettes on the reservation

or trust land where the purchaser’s business is located

invoices included in the claim.

over which the tribe has jurisdiction. The land on which

4. Click on “Add Invoice Information” and select/enter

the cigarette sales occur must have been designated a

reservation or trust land on or before January 1, 1983, or

purchase/credit detail for each invoice included in

on a later date if determined by an agreement between

the claim.

the department and the tribal council.

5. Lines 9 through 15 will auto-calculate based on the

RETAILER REQUIREMENTS

invoice information entered.

Unless otherwise stated in the agreement, the tribal

6. Copies of each invoice verifying cigarette purchases

council or retailers selling cigarettes on which the refund

and credits must be provided to the department.

claim is based must:

Invoices should be attached to the claim. Arrange

invoices by retailer invoice date (oldest to newest).

1. Be approved by the tribal council to purchase and

To attach invoices:

sell the cigarettes.

a. Scan and save the documents to a file on your

2. Not sell cigarettes to another retailer or cigarette

computer.

wholesaler.

b. Select the “Add” link in the “Attachment” box

3. Not deliver cigarettes via common carrier, contract

located in the left-hand column of the MTA

carrier, or the US Postal Service.

refund request.

4. Purchase all cigarettes bearing a Wisconsin Tribal

c. From the popup window, select “Browse.”

tax stamp from distributors holding a valid permit

with the department.

d. Locate and highlight the file to be attached and

then select “Open.”

5. Not sell unstamped cigarettes. Each pack must have

the special distinctive Wisconsin Tribal cigarette tax

e. Type a description of the file (i.e. CT-001, Period

stamp affixed.

ccyy-mm-dd) and then select “Save.”

UPDATING AUTHORIZED TRIBAL RETAILERS

If you are unable to attach invoices you may mail

The tribal council must notify the department, using tribal

them to the address shown below. Invoices received

letterhead, of changes to the following:

by mail will be returned after the department has

reviewed the refund claim.

• Retailers authorized to sell cigarettes (both additions

and deletions with effective start and/or end date).

INVOICE REQUIREMENTS

Note: For new retail locations, include copy of the

Each invoice must contain the following information:

parcel map and warranty deed.

• Business name or street address if an authorized

1. Date of sale.

retailer.

2. Name and address of purchaser.

FILING RESTRICTIONS

• Claims must be filed though My Tax Account (MTA)

3. Name and address of authorized retailer where the

or by a department approved XML schema.

cigarettes were delivered.

• A maximum of two refund claims may be filed by a

tribal council within a calendar month.

4. Name and address of seller.

CT-1instr (R. 3-13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2