Instructions For Form Rpd-41131 - Oil And Gas Taxes Summary Report

ADVERTISEMENT

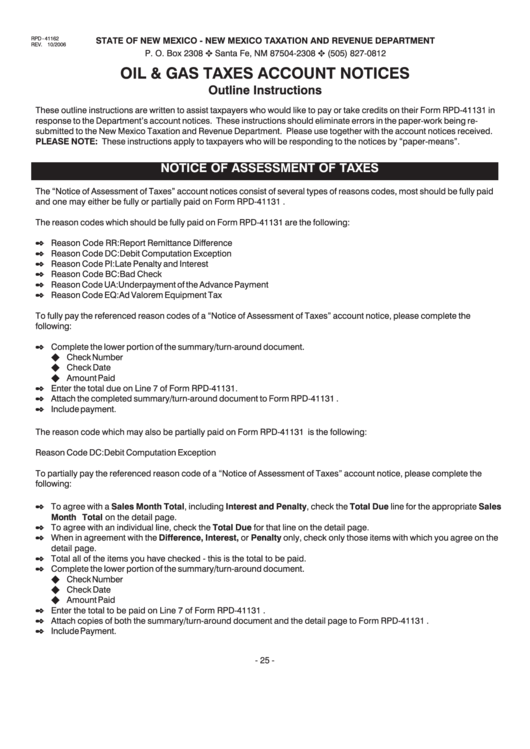

RPD - 41162

STATE OF NEW MEXICO - NEW MEXICO TAXATION AND REVENUE DEPARTMENT

REV. 10/2006

P . O. Box 2308

Santa Fe, NM 87504-2308

(505) 827-0812

OIL & GAS TAXES ACCOUNT NOTICES

Outline Instructions

These outline instructions are written to assist taxpayers who would like to pay or take credits on their Form RPD-41131 in

response to the Department’s account notices. These instructions should eliminate errors in the paper-work being re-

submitted to the New Mexico Taxation and Revenue Department. Please use together with the account notices received.

PLEASE NOTE: These instructions apply to taxpayers who will be responding to the notices by “paper-means”.

NOTICE OF ASSESSMENT OF TAXES

The “Notice of Assessment of Taxes” account notices consist of several types of reasons codes, most should be fully paid

and one may either be fully or partially paid on Form RPD-41131 .

The reason codes which should be fully paid on Form RPD-41131 are the following:

Reason Code RR: Report Remittance Difference

Reason Code DC: Debit Computation Exception

Reason Code PI:

Late Penalty and Interest

Reason Code BC: Bad Check

Reason Code UA:

Underpayment of the Advance Payment

Reason Code EQ:

Ad Valorem Equipment Tax

To fully pay the referenced reason codes of a “Notice of Assessment of Taxes” account notice, please complete the

following:

Complete the lower portion of the summary/turn-around document.

Check Number

Check Date

Amount Paid

Enter the total due on Line 7 of Form RPD-41131.

Attach the completed summary/turn-around document to Form RPD-41131 .

Include payment.

The reason code which may also be partially paid on Form RPD-41131 is the following:

Reason Code DC:

Debit Computation Exception

To partially pay the referenced reason code of a “Notice of Assessment of Taxes” account notice, please complete the

following:

To agree with a Sales Month Total, including Interest and Penalty, check the Total Due line for the appropriate Sales

Month Total on the detail page.

To agree with an individual line, check the Total Due for that line on the detail page.

When in agreement with the Difference, Interest, or Penalty only, check only those items with which you agree on the

detail page.

Total all of the items you have checked - this is the total to be paid.

Complete the lower portion of the summary/turn-around document.

Check Number

Check Date

Amount Paid

Enter the total to be paid on Line 7 of Form RPD-41131 .

Attach copies of both the summary/turn-around document and the detail page to Form RPD-41131 .

Include Payment.

- 25 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2