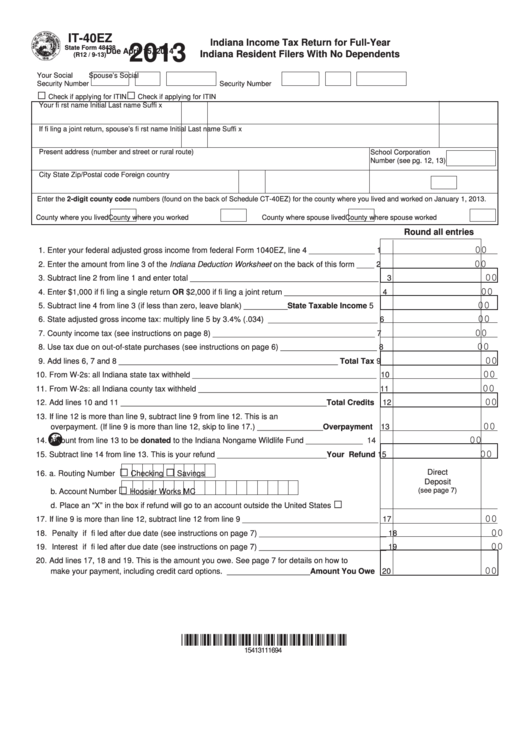

IT-40EZ

Indiana Income Tax Return for Full-Year

2013

State Form 48438

Due April 15, 2014

Indiana Resident Filers With No Dependents

(R12 / 9-13)

Your Social

Spouse’s Social

Security Number

Security Number

□

□

Check if applying for ITIN

Check if applying for ITIN

Your fi rst name

Initial

Last name

Suffi x

If fi ling a joint return, spouse’s fi rst name

Initial

Last name

Suffi x

Present address (number and street or rural route)

School Corporation

Number (see pg. 12, 13)

City

State

Zip/Postal code

Foreign country

2-character code

Enter the 2-digit county code numbers (found on the back of Schedule CT-40EZ) for the county where you lived and worked on January 1, 2013.

County where you lived

County where you worked

County where spouse lived

County where spouse worked

Round all entries

00

1. Enter your federal adjusted gross income from federal Form 1040EZ, line 4 _______________

1

00

2. Enter the amount from line 3 of the Indiana Deduction Worksheet on the back of this form ____

2

00

3. Subtract line 2 from line 1 and enter total ___________________________________________

3

00

4. Enter $1,000 if fi ling a single return OR $2,000 if fi ling a joint return ______________________

4

00

5. Subtract line 4 from line 3 (if less than zero, leave blank) __________ State Taxable Income

5

00

6. State adjusted gross income tax: multiply line 5 by 3.4% (.034) _________________________

6

00

7. County income tax (see instructions on page 8) _____________________________________

7

00

8. Use tax due on out-of-state purchases (see instructions on page 6) ______________________

8

00

9. Add lines 6, 7 and 8 __________________________________________________ Total Tax

9

00

10. From W-2s: all Indiana state tax withheld __________________________________________ 10

00

11. From W-2s: all Indiana county tax withheld _________________________________________ 11

00

12. Add lines 10 and 11 _______________________________________________ Total Credits

12

13. If line 12 is more than line 9, subtract line 9 from line 12. This is an

00

overpayment. (If line 9 is more than line 12, skip to line 17.) _______________ Overpayment

13

00

14.

Amount from line 13 to be donated to the Indiana Nongame Wildlife Fund _____________ 14

00

15. Subtract line 14 from line 13. This is your refund _________________________Your Refund 15

□

□

Direct

16. a. Routing Number

c.Type

Checking

Savings

Deposit

□

(see page 7)

b. Account Number

Hoosier Works MC

□

d. Place an “X” in the box if refund will go to an account outside the United States

00

17. If line 9 is more than line 12, subtract line 12 from line 9 _______________________________ 17

00

18. Penalty if fi led after due date (see instructions on page 7) _____________________________ 18

00

19. Interest if fi led after due date (see instructions on page 7) _____________________________ 19

20. Add lines 17, 18 and 19. This is the amount you owe. See page 7 for details on how to

00

make your payment, including credit card options. ___________________ Amount You Owe 20

15413111694

1

1 2

2