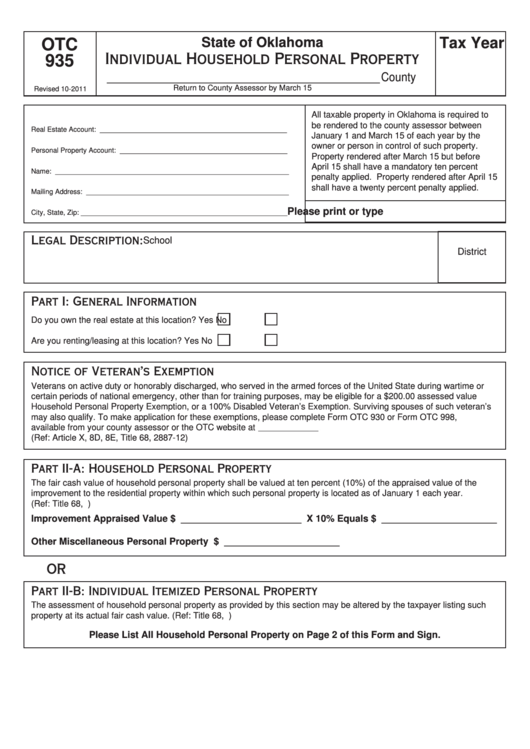

State of Oklahoma

Tax Year

OTC

Individual Household Personal Property

935

________________________________________ County

Return to County Assessor by March 15

Revised 10-2011

All taxable property in Oklahoma is required to

be rendered to the county assessor between

Real Estate Account: ________________________________________________

January 1 and March 15 of each year by the

owner or person in control of such property.

Personal Property Account: ___________________________________________

Property rendered after March 15 but before

April 15 shall have a mandatory ten percent

Name: ____________________________________________________________

penalty applied. Property rendered after April 15

shall have a twenty percent penalty applied.

Mailing Address: ____________________________________________________

Please print or type

City, State, Zip: _____________________________________________________

Legal Description:

School

District

Part I: General Information

Do you own the real estate at this location?

Yes

No

Are you renting/leasing at this location?

Yes

No

Notice of Veteran’s Exemption

Veterans on active duty or honorably discharged, who served in the armed forces of the United State during wartime or

certain periods of national emergency, other than for training purposes, may be eligible for a $200.00 assessed value

Household Personal Property Exemption, or a 100% Disabled Veteran’s Exemption. Surviving spouses of such veteran’s

may also qualify. To make application for these exemptions, please complete Form OTC 930 or Form OTC 998,

available from your county assessor or the OTC website at and return it to the county assessor.

(Ref: Article X, 8D, 8E, Title 68, 2887-12)

Part II-A: Household Personal Property

The fair cash value of household personal property shall be valued at ten percent (10%) of the appraised value of the

improvement to the residential property within which such personal property is located as of January 1 each year.

(Ref: Title 68, O.S. 2817-A)

Improvement Appraised Value $ _______________________ X 10% Equals $ ______________________

Other Miscellaneous Personal Property ............................................................ $ ______________________

OR

Part II-B: Individual Itemized Personal Property

The assessment of household personal property as provided by this section may be altered by the taxpayer listing such

property at its actual fair cash value. (Ref: Title 68, O.S. 2817-A)

Please List All Household Personal Property on Page 2 of this Form and Sign.

1

1 2

2