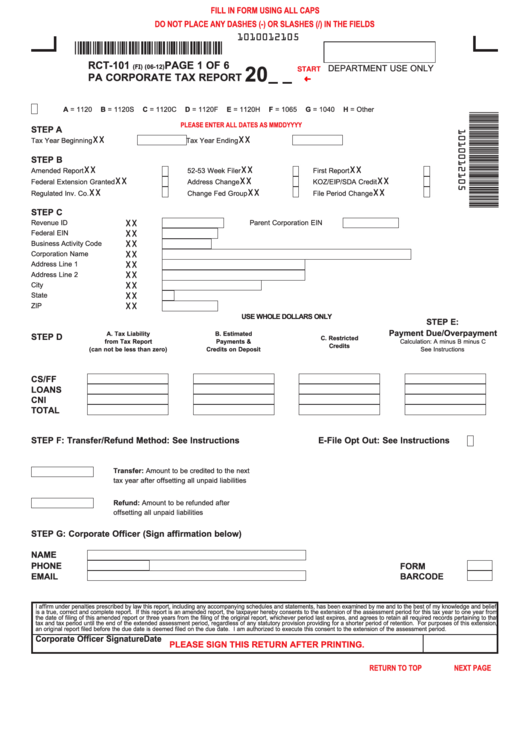

FILL IN FORM USING ALL CAPS

DO NOT PLACE ANY DASHES (-) OR SLASHES (/) IN THE FIELDS

1010012105

*1 01 001 21 05*

RCT-101

PAGE 1 OF 6

(FI) (06-12)

DEPARTMENT USE ONLY

START

20

PA CORPORATE TAX REPORT

A = 1120

B = 1120S

C = 1120C

D = 1120F

E = 1120H

F = 1065

G = 1040

H = Other

PLEASE ENTER ALL DATES AS MMDDYYYY

STEP A

XX

XX

Tax Year Beginning

Tax Year Ending

STEP B

XX

XX

XX

Amended Report

52-53 Week Filer

First Report

XX

XX

XX

Federal Extension Granted

Address Change

KOZ/EIP/SDA Credit

XX

XX

XX

Regulated Inv. Co.

Change Fed Group

File Period Change

STEP C

XX

Revenue ID

Parent Corporation EIN

XX

Federal EIN

XX

Business Activity Code

XX

Corporation Name

XX

Address Line 1

XX

Address Line 2

XX

City

XX

State

XX

ZIP

USE WHOLE DOLLARS ONLY

STEP E:

Payment Due/Overpayment

A. Tax Liability

B. Estimated

STEP D

C. Restricted

from Tax Report

Payments &

Calculation: A minus B minus C

Credits

(can not be less than zero)

Credits on Deposit

See Instructions

CS/FF

LOANS

CNI

TOTAL

E-File Opt Out: See Instructions

STEP F: Transfer/Refund Method: See Instructions

Transfer: Amount to be credited to the next

tax year after offsetting all unpaid liabilities

Refund: Amount to be refunded after

offsetting all unpaid liabilities

STEP G: Corporate Officer (Sign affirmation below)

NAME

PHONE

FORM

EMAIL

BARCODE

I affirm under penalties prescribed by law this report, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge and belief

is a true, correct and complete report. If this report is an amended report, the taxpayer hereby consents to the extension of the assessment period for this tax year to one year from

the date of filing of this amended report or three years from the filing of the original report, whichever period last expires, and agrees to retain all required records pertaining to that

tax and tax period until the end of the extended assessment period, regardless of any statutory provision providing for a shorter period of retention. For purposes of this extension,

an original report filed before the due date is deemed filed on the due date. I am authorized to execute this consent to the extension of the assessment period.

Corporate Officer Signature

Date

PLEASE SIGN THIS RETURN AFTER PRINTING.

PRINT FORM

Reset Entire Form

RETURN TO TOP

NEXT PAGE

1

1 2

2 3

3 4

4 5

5 6

6